How to Conduct a Thorough Contract Review Before You Sign

How to Conduct a Thorough Contract Review Before You Sign

Signing a contract without reading it ranks among the riskiest financial decisions you can make. Yet millions of Americans do exactly that every year—clicking "I agree" on software licenses, scribbling signatures on lease agreements, or accepting employment offers without understanding what they're committing to. The consequences range from unexpected fees to years of legal entanglement.

The good news? You don't need a law degree to protect yourself. What you need is a systematic approach to reading agreements and the ability to recognize when professional help becomes necessary.

Why Most People Skip Contract Reviews (And Why You Shouldn't)

Three factors drive most people to skip proper contract reviews: time pressure, intimidation, and misplaced trust.

Time pressure comes from salespeople, landlords, or employers who imply that hesitation signals distrust or indecision. "It's our standard agreement—everyone signs it" becomes a nudge toward carelessness. But standard doesn't mean fair, and widespread doesn't mean appropriate for your situation.

Intimidation stems from dense paragraphs filled with "whereas" and "hereinafter." Legal writing deliberately uses precision over clarity, which makes casual readers feel out of their depth. This feeling isn't accidental—complex language creates information asymmetry that benefits whoever drafted the document.

Misplaced trust assumes the other party has your interests at heart. Sometimes they do. Often they don't. Even well-intentioned businesses use contracts that heavily favor their position because their lawyers wrote those documents to minimize company risk, not to create balanced relationships.

The stakes justify the effort. A poorly reviewed employment contract might include a non-compete clause that prevents you from working in your industry for two years. A residential lease could make you liable for repairs that should fall to the landlord. A service agreement might auto-renew annually at increasing rates with no escape clause.

Understanding contract review basics protects your money, time, and future options. The hour you spend reading carefully now prevents months of regret later.

Breaking Down Contract Structure: What You're Actually Reading

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

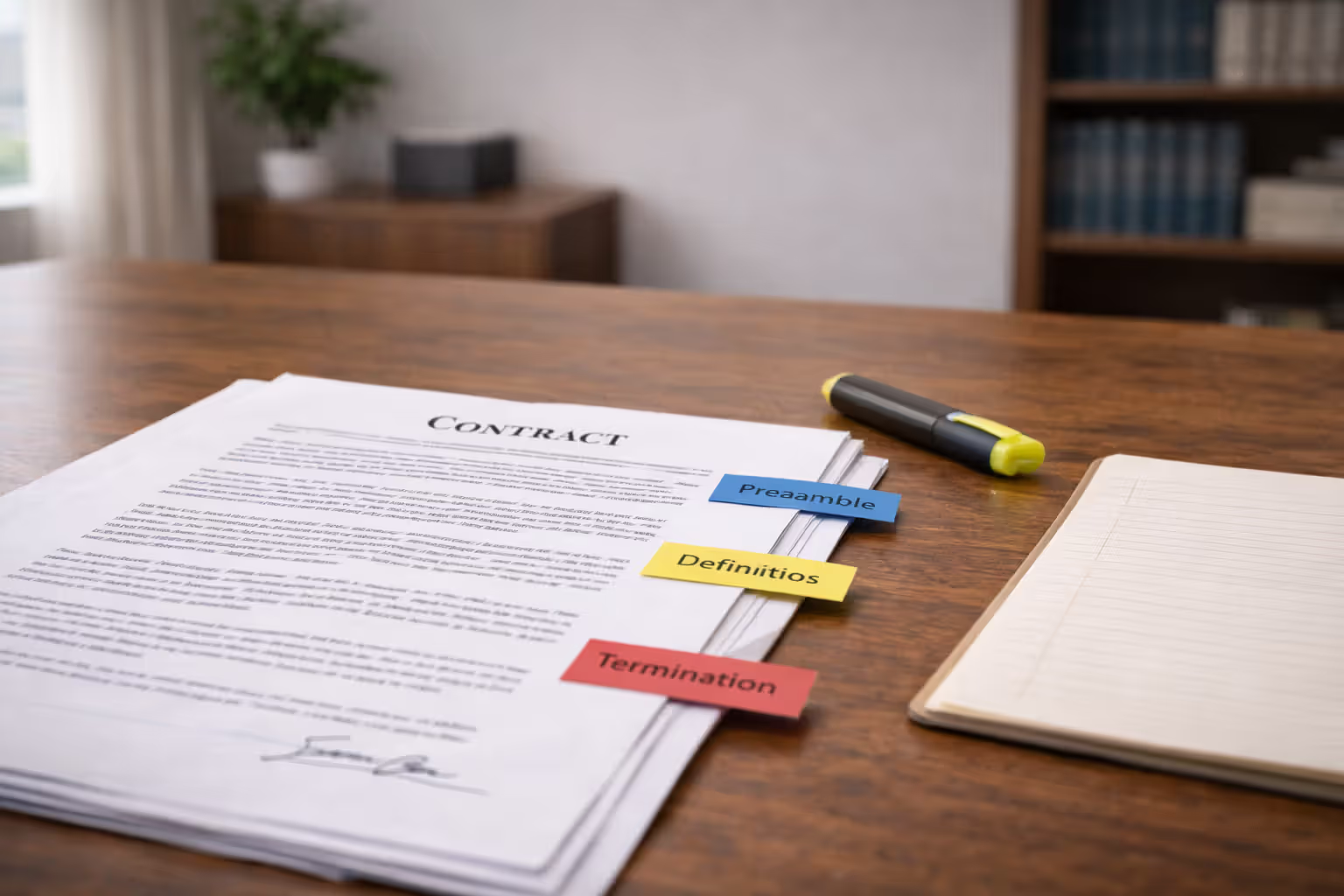

Contracts follow predictable patterns. Recognizing these patterns helps you navigate even lengthy documents efficiently.

The preamble identifies the parties and the contract date. Look for exactly how you're identified—if you're signing as an individual versus as a business representative, your personal liability changes dramatically. A contract where "Jane Smith" signs differs legally from one where "Jane Smith, on behalf of Smith Consulting LLC" signs.

Recitals appear next, usually starting with "Whereas." These background paragraphs establish context and intent. While not typically binding, recitals can influence how courts interpret ambiguous terms later. If recitals describe you as an independent contractor but operative clauses treat you like an employee, that inconsistency matters.

Operative clauses form the contract's meat—the actual obligations, rights, and terms. These sections use "shall," "will," and "must" to create binding requirements. Payment amounts, delivery schedules, performance standards, and consequences for breach all appear here. This is where you'll spend most of your review time.

Men must turn square corners when they deal with the Government.

— Justice Oliver Wendell Holmes, Jr.

Boilerplate provisions cluster near the end. Don't let the term "boilerplate" fool you into skimming. These clauses—covering topics like dispute resolution, amendment procedures, and severability—often determine what happens when things go wrong. A mandatory arbitration clause in the boilerplate might eliminate your right to sue in court, even if the company commits fraud.

Critical terms typically appear in three locations: the operative clauses (for primary obligations), definition sections (which control how key terms are interpreted throughout), and termination provisions (which explain how and when the relationship ends).

How to read a contract effectively means reading it twice. First pass: get the general structure and main obligations. Second pass: scrutinize the details, cross-reference defined terms, and identify gaps or contradictions.

Essential Contract Clauses You Must Understand

Certain clauses appear across most contract types. These provisions deserve extra attention because they directly impact your risk and flexibility.

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Payment and Compensation Terms

Payment clauses specify amounts, timing, and conditions. Watch for:

Ambiguous timing language like "payment due within 30 days" (30 days from what trigger—invoice date, delivery date, or something else?). Clear contracts specify: "Payment due within 30 days of invoice date."

Hidden fee structures that appear in subclauses. A $500 monthly service fee looks straightforward until you notice additional charges for "implementation" ($2,000), "maintenance" (15% annually), and "early termination" ($5,000). Calculate total potential costs, not just headline numbers.

Payment method restrictions that limit how you can pay or impose fees for certain methods. Some contracts require automatic bank withdrawals, giving the company direct access to your account.

Termination and Cancellation Rights

Termination clauses control how either party can exit the relationship. Key distinctions:

Termination for convenience lets you end the contract without proving the other party did anything wrong. "Either party may terminate with 60 days written notice" gives you flexibility. Contracts without this provision might lock you in until the term expires.

Termination for cause requires proving a material breach—the other party failed to perform significant obligations. These clauses often specify cure periods: "Non-breaching party must provide written notice and allow 30 days to cure before terminating." This protects both sides from hasty terminations over minor issues.

Automatic renewal provisions roll your contract into a new term unless you actively cancel. A one-year contract with automatic renewal becomes a two-year commitment if you miss the cancellation window. Some contracts require cancellation notice 90 days before the renewal date—miss that deadline and you're stuck for another full term.

Liability and Indemnification Clauses

These clauses determine who pays when something goes wrong.

Limitation of liability caps how much one party can recover from the other. "Company's total liability shall not exceed fees paid in the preceding 12 months" means if you paid $1,000 but suffered $50,000 in damages from their negligence, you can only recover $1,000. Companies often limit liability to amounts far below potential harm.

Indemnification requires one party to cover the other's legal costs and damages. "Client shall indemnify Company against all claims arising from Client's use of the service" makes you responsible if someone sues the company over how you used their product—even if the product was defective. Mutual indemnification clauses are fairer: both parties cover claims arising from their own actions.

Hold harmless clauses go further than indemnification by preventing you from even making a claim. "Client holds Company harmless from any injury or damage" might bar you from suing even for the company's gross negligence.

Dispute Resolution and Governing Law

When conflicts arise, these clauses control where and how you'll resolve them.

Governing law specifies which state's laws apply. A contract governed by Delaware law follows Delaware statutes and case precedent, regardless of where you live. This matters because contract laws vary significantly between states.

Venue selection determines which courts have jurisdiction. "All disputes shall be resolved in courts located in Suffolk County, Massachusetts" might require you to travel across the country to sue or defend yourself.

Arbitration clauses replace court proceedings with private arbitration. "All disputes shall be resolved through binding arbitration" typically means you waive your right to a jury trial and to participate in class actions. Arbitration can be faster and cheaper than court, but it can also favor companies that use the same arbitrators repeatedly.

Decoding Legal Terminology: A Plain-English Translation Guide

Legal terms create precision but obscure meaning for non-lawyers. This table translates frequently encountered terms:

| Legal Term | Plain English Meaning | Why It Matters |

| Indemnify | Reimburse someone for their losses and cover their legal costs | Makes you financially responsible for problems, even if you didn't directly cause them |

| Force majeure | Unforeseeable circumstances that prevent contract performance | Excuses non-performance during events like natural disasters; check what events qualify |

| Severability | If one clause is invalid, the rest of the contract remains enforceable | Prevents entire contract from collapsing if one provision is illegal |

| Waiver | Voluntarily giving up a right or claim | Once waived, you typically can't reclaim that right later |

| Material breach | Significant failure to perform contract obligations | Allows the non-breaching party to terminate; minor breaches usually don't |

| Liquidated damages | Pre-agreed amount paid if someone breaches | Avoids fighting over actual damages; check if the amount is reasonable |

| Assigns/Assignment | Transferring contract rights or obligations to someone else | The company might sell your contract to a third party you never agreed to work with |

| Covenant | A formal promise or commitment | Stronger than a simple obligation; breaching a covenant has serious consequences |

| Warrant/Warranty | Guarantee that something is true or will happen | If the warranty is false, you may have grounds to cancel or sue |

| Hereby | By means of this document | Just means "officially" or "formally"—adds no substantive meaning |

| Notwithstanding | Despite/regardless of | Signals an exception to other provisions; pay attention to what follows |

| In perpetuity | Forever | Rights granted "in perpetuity" never expire; be cautious granting unlimited timeframes |

| Confidentiality | Requirement to keep information secret | Violating this can trigger lawsuits; check what's covered and how long it lasts |

| Representations | Statements of past or present facts | You're asserting these facts are true; false representations can void the contract |

| Cure period | Time allowed to fix a breach before consequences apply | Gives you a chance to correct problems; note how much time you get |

Understanding agreements requires recognizing that legal wording often uses three words where one would suffice. "Cease and desist" just means "stop." "Null and void" means "invalid." This redundancy comes from English legal history, where lawyers combined Anglo-Saxon and Norman French terms to ensure clarity. Today it mostly adds formality.

Red Flags to Spot During Your Contract Review

Certain warning signs indicate problematic contracts that deserve extra scrutiny or professional review.

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Vague performance standards create disputes. "Contractor shall complete work in a timely manner" means nothing enforceable. Timely to you might mean two days; timely to them might mean two months. Specific contracts state: "Contractor shall deliver completed work within 14 business days of receiving all necessary materials."

One-sided modification rights let one party change terms unilaterally. "Company may modify this agreement at any time by posting changes to its website" means you're agreeing to unknown future terms. Fairer contracts require mutual consent for modifications or give you the right to terminate if terms change.

Unlimited liability makes you responsible for damages without caps. "Client is liable for all damages arising from any breach" could mean a $500 mistake costs you $500,000. Look for reasonable liability limits proportional to the contract value.

Evergreen clauses automatically renew contracts indefinitely. Combined with short cancellation windows, these provisions trap you in perpetual relationships. A three-year contract with 90-day cancellation notice and automatic renewal could extend for decades if you forget one deadline.

Missing essential terms signal incomplete agreements. If a contract doesn't specify payment amounts, delivery dates, or performance standards, you're signing a blank check. Never accept "details to be determined later" for critical terms.

Excessive confidentiality that restricts discussing the contract itself. "All terms of this agreement are confidential" might prevent you from seeking legal advice or reporting illegal conduct. Reasonable confidentiality protects trade secrets, not the contract's existence.

Waiver of consumer protections attempts to eliminate your legal rights. "Client waives all statutory rights and remedies" might not be enforceable (many consumer protections can't be waived), but it signals an aggressive drafting approach.

One who signs a contract is presumed to know its contents and to assent to them.

— Justice Horace Gray

Real example of problematic wording: "Fees may be adjusted annually based on market conditions as determined by Company in its sole discretion." This gives the company unlimited pricing power with no objective standard. Better wording: "Fees may increase annually by no more than the Consumer Price Index percentage change or 5%, whichever is less."

Step-by-Step Contract Review Checklist

Follow this systematic process for thorough contract reviews:

Step 1: Read the entire document once without marking anything. Get the overall structure and purpose. Note sections that confuse you but don't stop to research yet.

Step 2: Identify and highlight all defined terms. Contracts typically capitalize and define key terms like "Services," "Deliverables," or "Confidential Information." Find the definitions section and mark each defined term wherever it appears. Misunderstanding definitions causes most contract disputes.

Step 3: Extract and list your obligations. Create a separate document listing everything you must do, pay, or provide. Include deadlines, quality standards, and consequences for non-performance. This transforms abstract legal language into concrete to-do items.

Step 4: Extract and list their obligations. What must the other party deliver? By when? To what standard? If their obligations seem vague compared to yours, the contract is unbalanced.

Step 5: Locate and analyze the money trail. How much do you pay? When? What triggers additional fees? What happens if you're late? What refund rights do you have? Calculate worst-case costs assuming everything that can be charged will be charged.

Step 6: Find the exit doors. How can you terminate? How can they terminate? How much notice is required? What penalties apply? Can you get out if circumstances change? Contracts you can't exit are contracts you should rarely enter.

Step 7: Identify the risk allocators. Who's liable for what? Are there liability caps? Who indemnifies whom? Does insurance cover these risks? Understanding risk helps you decide if the deal justifies potential downsides.

Step 8: Check the dispute resolution mechanism. Where would conflicts be resolved? Under what state's laws? Through arbitration or court? How much would it cost to enforce your rights? Sometimes the dispute resolution process makes small claims economically impossible to pursue.

Step 9: Look for missing protections. Does the contract address what happens if they go bankrupt? If they're acquired by a competitor? If key personnel leave? If their product is discontinued? Gaps often matter more than what's included.

Step 10: Compare against your requirements. Before signing anything significant, write down what you need from this relationship. Does the contract deliver that? Are there deal-breakers present? Does it create obligations you can't meet?

Step 11: Research unfamiliar terms. Look up every term you don't fully understand. Legal dictionaries like Black's Law Dictionary or free online resources can clarify meanings. Don't guess.

Step 12: Prepare negotiation points. List provisions you want changed, deleted, or added. Prioritize them: which are deal-breakers versus nice-to-haves? Most contracts are negotiable, especially for significant relationships or amounts.

Rule of thumb: Spend review time proportional to the contract's value and duration. A $50 monthly subscription for one year deserves 30 minutes. A $50,000 annual service agreement deserves several hours plus professional review.

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Frequently Asked Questions About Contract Reviews

Protecting Yourself Through Informed Contract Decisions

Contract review isn't about paranoia or assuming bad faith. It's about understanding what you're agreeing to before you're legally bound to do it. Most contracts work out fine because both parties perform as expected. But contracts exist precisely for when things don't go as expected—when circumstances change, when parties disagree, or when someone fails to deliver.

The time you invest in understanding agreements protects your interests, clarifies expectations, and often improves relationships. When both parties clearly understand their obligations, disputes decrease. When you negotiate unclear terms before signing, you prevent conflicts later.

Start with small, low-stakes contracts to build your review skills. Practice identifying key clauses, extracting obligations, and spotting vague language. As you develop familiarity with common patterns, you'll review more efficiently and recognize problems more quickly.

Remember that reading a contract carefully isn't an insult to the other party—it's a basic business practice. Anyone who pressures you to sign without reading either doesn't understand contracts or doesn't have your best interests in mind. Neither situation should inspire confidence.

Your signature represents your commitment. Make sure you know what you're committing to before you put your name on the line.

Related Stories

Read more

Read more

The content on skeletonkeyorganizing.com is provided for general informational and inspirational purposes only. It is intended to showcase fashion trends, style ideas, and curated collections, and should not be considered professional fashion, styling, or personal consulting advice.

All information, images, and style recommendations presented on this website are for general inspiration only. Individual style preferences, body types, and fashion needs may vary, and results may differ from person to person.

Skeletonkeyorganizing.com is not responsible for any errors or omissions, or for actions taken based on the information, trends, or styling suggestions presented on this website.