Two people signing a settlement agreement with payment terms and release section visible

Settlement Agreement Template: Free Download and Complete Drafting Guide

Disputes cost money. Court battles drain bank accounts faster than almost any other business expense, and even winning feels like losing when you tally up attorney fees. That's why settlement agreements exist—they let you resolve conflicts outside the courtroom while creating binding obligations both sides must follow. Need to end an employment dispute? Settle a contract disagreement? Close the books on a property damage claim? The right settlement document protects what matters to you and prevents the dispute from reigniting months later.

What Makes a Settlement Agreement Legally Binding

Four elements transform a handshake deal into an enforceable contract: offer, acceptance, consideration, and genuine intent to create legal obligations. Miss even one, and you're left with an unenforceable promise that wastes everyone's time.

Consideration is the linchpin. Each party must surrender something they weren't already obligated to give up. When an employee agrees to drop a discrimination complaint in exchange for four months' severance, both sides make a sacrifice—the employer parts with cash it didn't technically owe, and the employee relinquishes the right to sue. Courts don't care if the trade seems lopsided. They only verify that both parties gave up something real.

Here's what consideration isn't: fulfilling a duty you already had. An employer who "settles" a minimum wage dispute by agreeing to pay the exact wages legally owed hasn't provided consideration. You need to add something extra—maybe an expedited payment schedule, a neutral reference letter, or additional severance beyond statutory requirements.

Both signers need legal authority to bind themselves. Minors can't sign away settlement rights without a parent or court stepping in. A manager at a corporation can't commit the company to a $75,000 payout unless they have documented authority from the board or executive team. I've seen deals collapse because someone assumed the person across the table had power they didn't actually possess.

The agreement can't involve fraud, threats, or fundamental misunderstandings about key facts. Courts will tear up a settlement if one party hid critical information or made threats to force a signature. Imagine a landlord settling a habitability complaint while secretly knowing about toxic mold in the walls—that concealment gives the tenant grounds to void the entire agreement later.

Most states don't require notarization, though California and a few others mandate it for real estate settlements or agreements above certain dollar thresholds. Check your state's requirements before assuming a simple signature suffices.

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Core Components Every Settlement Agreement Must Include

Dispute Settlement Contract Structure Basics

Think of a settlement agreement like a building—it needs solid architecture or the whole thing crumbles. The document opens with a title, execution date, and party identification. Then comes the "recitals" section where you tell the dispute's story without admitting fault. After that, you get into the meat: payment obligations, release language, confidentiality terms, and mutual promises. Everything closes with signature blocks, execution dates, and notarization spaces if your jurisdiction requires them.

Why does structure matter this much? Because vague contracts spawn lawsuits. A payment clause stating "Defendant shall pay $10,000" leaves crucial gaps. By what date? Via check, wire, or cash? What happens if payment arrives late? Proper structure answers these questions before they become courtroom battles.

Parties and Recitals Section

Begin with complete legal identification. Write "Robert Chen, an individual residing at 742 Maple Drive, Austin, Texas 78701" instead of just "Robert Chen." Business entities need even more detail: "Skyline Contractors LLC, a Texas limited liability company with its principal place of business in Houston, Texas."

Recitals establish context using "WHEREAS" statements. They confirm a dispute exists, sketch its general contours, and establish that both parties want resolution without litigation—crucially, without admitting who's right. Here's a sample: "WHEREAS, disagreements have arisen between the parties regarding payment for construction services performed at 1840 Commerce Street between January and March 2024; and WHEREAS, Skyline Contractors denies any defects in its work but wishes to avoid protracted litigation..."

Don't dismiss these introductory paragraphs as formalities. When contract language gets fuzzy later, judges look back to the recitals to understand what the parties actually intended to accomplish. They're your roadmap for interpreting ambiguous terms.

Discourage litigation. Persuade your neighbors to compromise whenever you can.

— Abraham Lincoln

Legal Release Clauses That Protect Both Sides

The release clause does the heavy lifting. It defines precisely which legal claims each party is giving up. Broad releases sweep away "all claims, known or unknown, arising from or relating to" the dispute. Narrow releases target specific legal theories: "Contractor releases claims under breach of contract and quantum meruit arising from the Commerce Street project but reserves all other claims."

General releases provide maximum closure but carry real risk. Sign away "all claims" related to a workplace injury, and you can't sue later when doctors discover a spinal injury that wasn't obvious during initial settlement talks. Most states enforce these sweeping waivers unless you can prove fraud or mutual mistake about material facts.

Mutual releases offer balanced protection. Instead of only the complainant releasing claims, the defendant also waives counterclaims and future disputes stemming from the same events. This prevents defendants from later filing malicious prosecution or abuse of process suits.

Smart agreements include carve-outs for specific rights you want to preserve. Common exceptions: rights to enforce the settlement itself, tax indemnification claims, obligations under separate contracts, and regulatory compliance issues. An employee might release all employment claims while explicitly preserving vested retirement benefits or stock option rights that existed independently.

Claim Waiver Provisions and Scope Limitations

Effective claim waivers identify what you're surrendering by legal theory (breach of contract, negligence, defamation), time period (all claims arising before December 31, 2024), and subject matter (the restaurant franchise at 500 Oak Boulevard).

Some claims can't be waived, period. Federal law bars employees from waiving their right to file EEOC charges, though they can waive monetary recovery from such charges. Workers' compensation claims require administrative approval in virtually every state. Future claims based on facts you don't yet know about may resist waiver depending on which state's law applies.

The Older Workers Benefit Protection Act adds extra requirements when employees over 40 release age discrimination claims. The waiver must specifically reference the Age Discrimination in Employment Act by name, advise consulting an attorney, provide 21 days for consideration (45 days for group layoffs), and allow seven days to revoke after signing. Skip any of these requirements and the release fails.

Scope limitations prevent overreach. A release resolving a slip-and-fall at a grocery store shouldn't waive the plaintiff's completely unrelated medical malpractice claim against her surgeon. Courts interpret ambiguous releases against the party who drafted them, so vague language often fails to bar the claims you thought you were extinguishing.

How to Structure Settlement Payment Terms

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

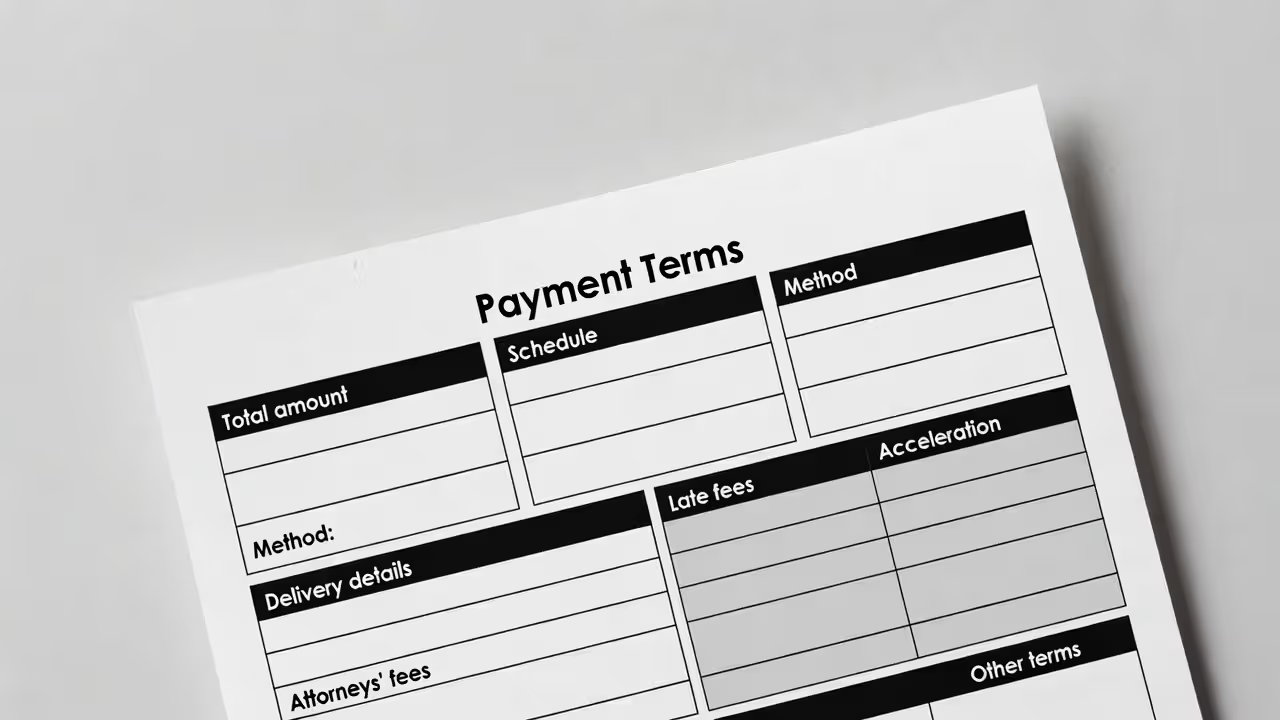

Payment terms trigger more post-settlement fights than any other contract provision. Vague language like "Defendant agrees to pay $30,000" creates a minefield. When's payment due? How should it be sent? Can the plaintiff demand interest for late payment? What remedies exist if the defendant never pays?

Well-structured payment terms eliminate ambiguity. Start with the total, then detail the schedule: "Defendant shall pay Plaintiff Thirty Thousand Dollars ($30,000.00) according to this schedule: (a) Twelve Thousand Dollars ($12,000.00) within seven (7) business days following execution of this Agreement; and (b) Eighteen Thousand Dollars ($18,000.00) on or before July 15, 2024, by 5:00 p.m. Central Time."

Lump sum payments minimize hassle and eliminate the risk of missed installments down the road. They work best when the paying party has immediate liquidity and everyone wants clean finality. Always request certified funds or wire transfers rather than personal checks to avoid bounced payment nightmares.

Installment arrangements help defendants manage cash flow but demand protective mechanisms. Build in an acceleration provision: "If Defendant misses any payment by more than ten (10) calendar days, the entire remaining balance becomes immediately due and payable." Without this, you're stuck waiting months to realize you have a systematic default problem.

Nail down the exact payment method: wire transfer, cashier's check, money order, ACH transfer. Provide granular delivery instructions—account numbers and routing information for electronic payments, or a specific mailing address with recipient name for physical checks. Specify that payment isn't complete until funds are received and cleared, not when sent.

Spell out default consequences explicitly. Beyond acceleration, consider reasonable late fees (staying within your state's usury caps), mandatory attorneys' fees for collection efforts, and confession of judgment provisions if your state permits them. Under a confession of judgment, the creditor can secure a court judgment without filing a new lawsuit—just file the agreement with proof that default occurred.

Tax treatment deserves careful attention. Settlements compensating for physical injuries or physical sickness generally escape taxation under IRC Section 104. Money received for emotional distress, back wages, or punitive damages gets taxed as ordinary income. The agreement should state how payments will be characterized and identify who handles tax reporting obligations. Build in IRS Form 1099 requirements when they apply.

Security mechanisms protect claimants when payments are stretched over time. Consider personal guarantees from business owners, property liens, escrow accounts funded at signing, or irrevocable standby letters of credit. If you're settling a $150,000 claim for payments spread across 18 months, require the defendant to deposit the full amount with an escrow agent who releases funds according to the agreed schedule.

Common Mistakes That Invalidate Settlement Agreements

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Fuzzy language kills more settlements than any other defect. A release covering "all workplace-related claims" might not bar a subsequent lawsuit over vested pension rights if courts in your state treat retirement benefits as separate from employment relationships. Precision solves this: "Employee releases all claims arising from or connected to employment or termination, including without limitation claims for unpaid wages, discrimination, harassment, retaliation, and wrongful discharge, expressly excluding only vested benefits under the XYZ Pension Plan as of the termination date."

Missing signatures seem obvious yet happen with disturbing frequency. Every party must sign. When a corporation is involved, the signature block needs the signer's title plus ideally a representation that they possess authority to bind the entity. Without this detail, the individual who signed might face personal liability while the company walks away untouched.

Insufficient consideration destroys enforceability. Promising to perform an existing legal obligation doesn't qualify as valid consideration. An employer can't "settle" unpaid overtime by agreeing to pay wages already owed under the Fair Labor Standards Act—that's a preexisting duty, not consideration. You need something additional: extra severance, a favorable reference, accelerated payment, or mutual releases.

Excessively broad releases sometimes collapse under scrutiny. A release covering "any and all claims of any nature whatsoever, whether known or unknown, past, present, or future" may fail as contrary to public policy when it attempts to waive statutory rights that can't be contracted away. Courts examine releases of consumer protection claims, wage-and-hour rights, and civil rights protections more skeptically than ordinary breach-of-contract disputes.

Ignoring statutory requirements dooms settlements in regulated contexts. The Fair Labor Standards Act requires either Department of Labor supervision or court approval for wage settlements. State mechanics' lien statutes often mandate specific waiver language and recording procedures for construction payment disputes. Workers' compensation settlements need administrative sign-off in nearly every jurisdiction. Miss these procedural requirements and your settlement might be worthless.

Unconscionability can void agreements even when all technical boxes are checked. Courts examine whether terms are so lopsided that enforcement would be fundamentally unfair. A settlement forcing an injured plaintiff to pay the defendant's legal bills while receiving only token consideration probably won't survive judicial review.

Inadequate consideration for mutual releases creates enforceability problems. If both parties merely release claims against each other without any money or tangible benefit changing hands, some courts find the consideration insufficient. At least one party should provide something beyond the mutual release—even a nominal $100 payment can satisfy this technical requirement.

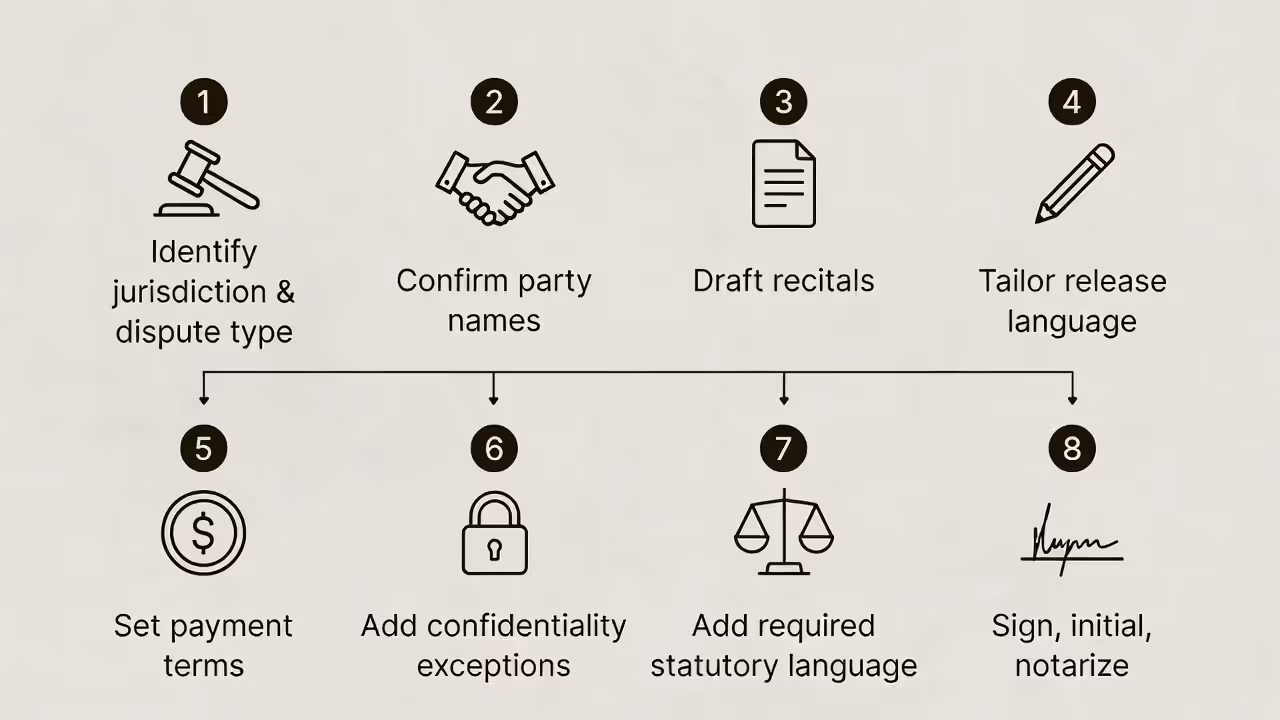

Step-by-Step: Customizing Your Settlement Agreement Template

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Begin by pinpointing your jurisdiction and dispute category. Employment settlements in California demand different provisions than contract disputes in Florida. Download a template designed for your specific situation instead of grabbing a generic form that might omit crucial protections.

Complete the caption with full party details. For individuals, list complete legal names and current addresses. For businesses, confirm the precise legal entity name by checking the Secretary of State's database—"Metro Services" might actually be registered as "Metro Services, Inc." or "Metro Services LLC." Getting this detail wrong can make your agreement unenforceable against the intended party.

Tailor the recitals to describe your specific dispute without making admissions that could hurt you if the settlement later unravels. Rather than "Defendant's defective product caused $65,000 in property damage," write "A disagreement arose concerning alleged product defects and claimed property damage."

Revise the release clause to fit your circumstances. Settling an employment dispute? Verify that the release covers employment-related claims while carving out vested benefits and retirement accounts. Settling a personal injury? Decide whether you want a comprehensive "known and unknown injuries" release or prefer limiting it to injuries identified before signing.

Customize payment terms to match your actual deal. Replace template brackets with real dollar amounts, specific dates, and designated payment methods. Using installments? Add an acceleration clause and late payment penalties. Clarify whether stated amounts include interest and who pays wire transfer fees.

Examine confidentiality provisions with a critical eye. Many templates include mutual non-disclosure language preventing parties from discussing settlement terms with anyone. Think through whether you need exceptions for communications with attorneys, accountants, tax authorities, family members, or disclosures compelled by subpoena. Some states restrict confidentiality in settlements involving sexual harassment or public safety issues.

Details create the big picture.

— Sanford I. Weill

Insert jurisdiction-specific requirements that templates often omit. California settlements releasing Labor Code violations should include Civil Code Section 1542 waiver language acknowledging that unknown claims are being released. Federal age discrimination releases need compliance with the Older Workers Benefit Protection Act's mandatory provisions.

Build in dispute resolution procedures for settlement enforcement issues. Rather than permitting immediate litigation if disagreements emerge about the agreement's meaning, require mediation first. This creates a buffer zone that often resolves misunderstandings without generating new lawsuits.

Have all parties initial every page and sign the final signature block with dates written next to each signature. If notarization is required or recommended in your state, add proper acknowledgment sections and visit a notary before treating the agreement as final.

Red flags demanding legal counsel: disputes exceeding $10,000, cases involving complex legal theories, situations where one party lacks business sophistication, agreements releasing claims you don't fully comprehend, settlements requiring court approval, and any agreement involving minors or incapacitated individuals.

When to Use Mediation vs. Direct Settlement Agreements

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Mediation brings in a neutral third party who guides negotiations but can't force a resolution. Direct settlement means the parties negotiate face-to-face or through their lawyers without any mediator. Each strategy fits different situations.

| Feature | Mediated Settlement | Direct Settlement |

| Cost | Mediator charges $200-$500 hourly (typically split); total usually runs $1,000-$5,000 | Only attorney fees; typically $500-$3,000 total |

| Timeline | One to three sessions spanning 2-6 weeks | Two to eight weeks of back-and-forth negotiation |

| Formality | Structured process with established ground rules | Flexible, informal exchanges without set procedures |

| Third-party involvement | Neutral mediator manages communication and momentum | Only the parties and their legal counsel participate |

| Success rate | Roughly 70-80% of mediations produce agreement | Approximately 40-60% of direct negotiations succeed |

| Best for | High-emotion conflicts, communication breakdowns, complex multi-party disputes | Straightforward disagreements, cooperative parties, clear liability situations |

| Enforceability | Identical to direct settlements once documented in writing | Immediately enforceable upon signing |

Pick mediation when emotions dominate the dispute. An employment discrimination case where the employee feels personally violated and the employer feels unjustly accused benefits from a mediator who can shuttle between separate rooms, reframe inflammatory positions, and defuse tension. Direct negotiation in these situations often devolves into accusations and deadlock.

Direct settlement works beautifully when liability is obvious and the only question is quantum. A car accident with undisputed fault and $12,000 in medical bills documented by hospital records doesn't need mediation—the parties can usually negotiate a settlement multiple through straightforward discussion between insurance adjusters or attorneys.

Multi-party disputes strongly favor mediation. When three subcontractors blame each other for project delays and cost overruns, a mediator can manage the intricate dynamics and help forge a three-way resolution. Direct negotiation among multiple parties often stalls as each side waits for others to make the first concession.

Power imbalances sometimes necessitate mediation. When a multinational corporation negotiates with an individual consumer, the mediator helps level the playing field by ensuring both voices get heard and preventing intimidation tactics that might otherwise dominate the negotiation.

Budget-conscious parties might skip mediation to avoid mediator fees, but this math can backfire spectacularly. If direct negotiation fails and litigation ensues, the mediator fee you "saved" becomes trivial compared to discovery costs, expert witness fees, and trial preparation expenses. Mediation usually costs less than even early-stage litigation.

Court-mandated mediation eliminates the choice. Many jurisdictions require mediation before cases can proceed to trial. These mandatory sessions often succeed because parties know trial is the alternative and judges may sanction parties who don't negotiate in good faith during the mediation.

Your dispute resolution settlement terms should specify how you'll handle disagreements about the settlement itself. Include a provision requiring mediation of any disputes about interpretation or enforcement before either party can file suit. This prevents minor misunderstandings from spawning expensive new litigation.

Frequently Asked Questions About Settlement Agreements

Settlement agreements transform uncertain legal battles into definite, enforceable obligations that let everyone move forward. A well-crafted agreement eliminates litigation risk, establishes clear payment expectations, and closes the books on disputes that might otherwise fester for years. The critical ingredient is specificity: unambiguous party identification, precise payment schedules with default remedies, carefully tailored releases that match your situation, and explicit procedures for handling any disputes about the settlement itself. Templates provide useful starting points, but customization for your jurisdiction and dispute type isn't optional—it's essential for creating an enforceable agreement. For straightforward, low-dollar disputes, a carefully customized template might suffice. For complex cases or substantial amounts, investing in legal review prevents costly mistakes that could unravel everything you thought you'd resolved. Whether you negotiate face-to-face or through mediation, the final written agreement determines whether your settlement delivers lasting peace or spawns new conflict.

Related Stories

Read more

Read more

The content on Legal Insights is provided for general informational purposes only. It is intended to offer insights, commentary, and analysis on legal topics and developments, and should not be considered legal advice or a substitute for professional consultation with a qualified attorney.

All information, articles, and materials presented on this website are for general informational purposes only. Laws and regulations may vary by jurisdiction and may change over time. The application of legal principles depends on specific facts and circumstances.

Legal Insights is not responsible for any errors or omissions in the content, or for any actions taken based on the information provided on this website. Users are encouraged to seek independent legal advice tailored to their individual situation before making any legal decisions.