Business owner and contractor reviewing an independent contractor agreement at a table

Independent Contractor Agreement: Essential Clauses and Legal Requirements for US Businesses

An independent contractor agreement is a legally binding document that establishes the terms under which a business engages a self-employed individual or entity to perform specific services. Unlike employment contracts, these agreements create a business-to-business relationship rather than an employer-employee dynamic.

The distinction matters because misclassification can trigger significant financial penalties. The IRS examines behavioral control (who directs how work gets done), financial control (who manages business aspects of the worker's job), and the type of relationship (contracts, benefits, permanency). Meanwhile, the Department of Labor applies its own tests to determine whether workers qualify for protections under the Fair Labor Standards Act.

Contractor relationship law has evolved substantially. A properly drafted agreement protects both parties by clarifying expectations, limiting liability exposure, and documenting the independent nature of the relationship. For the hiring party, it prevents allegations of employment misclassification. For contractors, it secures payment terms and defines deliverables clearly enough to avoid scope creep.

Consider a software developer hired to build a mobile app. Without a clear agreement, disputes arise: Who owns the code? What happens if the developer misses deadlines? Can the client demand unlimited revisions? An independent contractor agreement answers these questions before work begins, reducing friction and legal risk.

The IRS uses Form SS-8 to make determinations when classification disputes arise. Businesses that misclassify workers face back taxes, penalties for unpaid employment taxes, and potential employee benefit liabilities. The stakes justify careful attention to how these agreements are structured.

| Factor | Employee | Independent Contractor |

| Control over work | Employer dictates when, where, and how work is performed | Contractor controls methods and schedule |

| Payment method | Regular salary or hourly wages; paid regardless of project completion | Project-based or milestone payments; paid for results |

| Benefits | Eligible for health insurance, retirement plans, paid leave | No benefits; responsible for own insurance and retirement |

| Tax withholding | Employer withholds income tax, Social Security, Medicare | Contractor receives gross payment; handles own tax obligations |

| Equipment | Employer provides tools, software, workspace | Contractor provides own tools and workspace |

| Termination rights | Subject to employment laws; may require cause or notice | Either party can terminate per contract terms; fewer legal protections |

Core Components Every Contractor Agreement Must Include

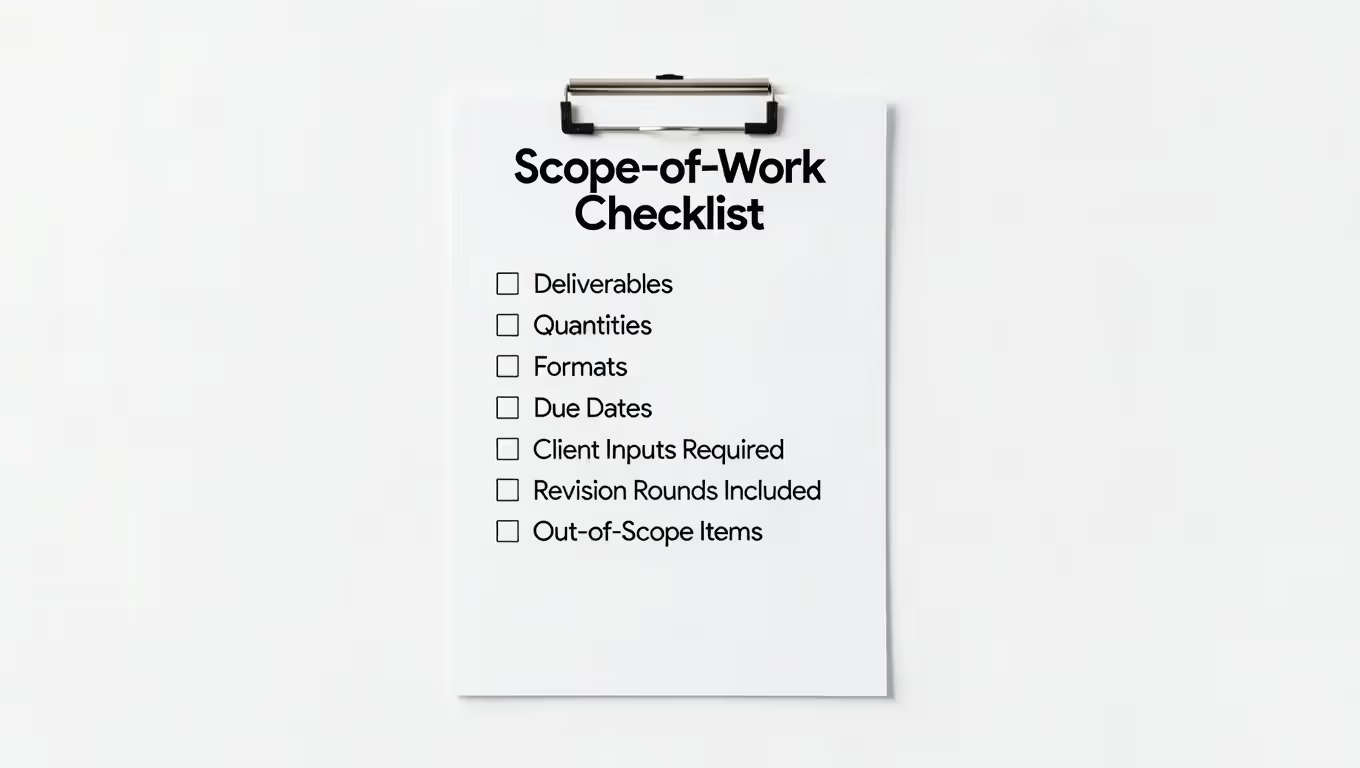

Work Scope Provisions: Defining Deliverables and Responsibilities

Author: David Kessler;

Source: skeletonkeyorganizing.com

Work scope provisions eliminate ambiguity about what the contractor will deliver. Vague language like "provide marketing services" invites disputes. Instead, specify: "Develop and execute a 90-day social media campaign including 45 Instagram posts, 30 Facebook posts, and bi-weekly analytics reports."

Detailed scope provisions protect contractors from endless revision requests. They also help businesses evaluate whether deliverables match expectations. Include acceptance criteria—the measurable standards that determine when work is complete. For a graphic designer, this might specify: "Two rounds of revisions included; additional changes billed at $75/hour."

Address what falls outside the scope. If a web developer agrees to build a five-page website, explicitly state that e-commerce functionality, custom plugins, or ongoing maintenance require separate agreements. This prevents scope creep that erodes contractor profitability and strains client relationships.

Payment Terms: Rates, Schedules, and Invoice Requirements

Payment structure clauses should specify the compensation model: fixed fee, hourly rate, or milestone-based payments. For hourly arrangements, cap total hours or require approval for work exceeding estimates. A contractor billing $150/hour on a project estimated at 40 hours should clarify whether hours 41-50 need written authorization.

Payment schedules matter equally. Net-30 terms (payment due 30 days after invoice) are common, but contractors often negotiate net-15 or require deposits. A 50% upfront payment protects contractors from clients who disappear mid-project. For longer engagements, monthly invoicing prevents cash flow problems.

Detail invoice requirements: What information must invoices contain? Where should contractors submit them? Many disputes arise from invoices sent to the wrong email address or missing required purchase order numbers. Specify late payment consequences—a 1.5% monthly interest charge encourages timely payment without being punitive.

Timeline and Project Milestones

Deadlines create accountability. Rather than "website completed in three months," break projects into milestones: "Wireframes approved by March 15; design mockups delivered March 30; development complete April 30; final launch May 15." Each milestone should trigger a payment or approval step.

Build in contingencies for delays outside the contractor's control. If a client takes three weeks to provide necessary information, the contractor shouldn't be penalized for late delivery. Include language like: "Timeline extends by the duration of any client-caused delays, including late feedback, content provision, or approval cycles."

Address what happens when deadlines slip. Does the client have termination rights? Can the contractor subcontract to meet deadlines? These provisions prevent minor delays from escalating into contract breaches.

Intellectual Property Ownership

Intellectual property clauses determine who owns work product. By default, contractors retain copyright to their creations. Businesses typically require a "work made for hire" clause or assignment of rights, transferring ownership upon payment.

Specify exactly what transfers. If a contractor develops software using pre-existing code libraries they've built, does the client own those too? Smart contractors retain ownership of general tools and methods, licensing only the specific deliverable. A graphic designer might transfer logo rights while retaining the right to reuse design techniques.

Address moral rights and portfolio use. Can contractors display work samples? Use the project as a case study? Some clients require confidentiality that prevents portfolio inclusion; contractors should negotiate this upfront, as portfolio work drives future business.

| Clause Type | Purpose | Risk if Omitted |

| Scope of work | Defines specific deliverables, responsibilities, and project boundaries | Unlimited revision requests; disputes over what was promised; scope creep |

| Payment terms | Establishes rates, schedules, invoice procedures, and late payment consequences | Payment delays; disputes over amounts owed; cash flow problems |

| IP ownership | Clarifies who owns work product, code, designs, and derivative works | Ownership disputes; inability to use deliverables; licensing conflicts |

| Confidentiality | Protects sensitive business information, trade secrets, and proprietary data | Information leaks; competitive harm; loss of trade secret protection |

| Liability | Limits damages, defines indemnification obligations, establishes insurance requirements | Unlimited liability exposure; costly litigation; uninsured losses |

| Termination | Specifies notice periods, termination rights, and consequences of early ending | Abrupt project cancellation; disputes over partial payment; relationship damage |

Critical Legal Clauses That Protect Both Parties

Author: David Kessler;

Source: skeletonkeyorganizing.com

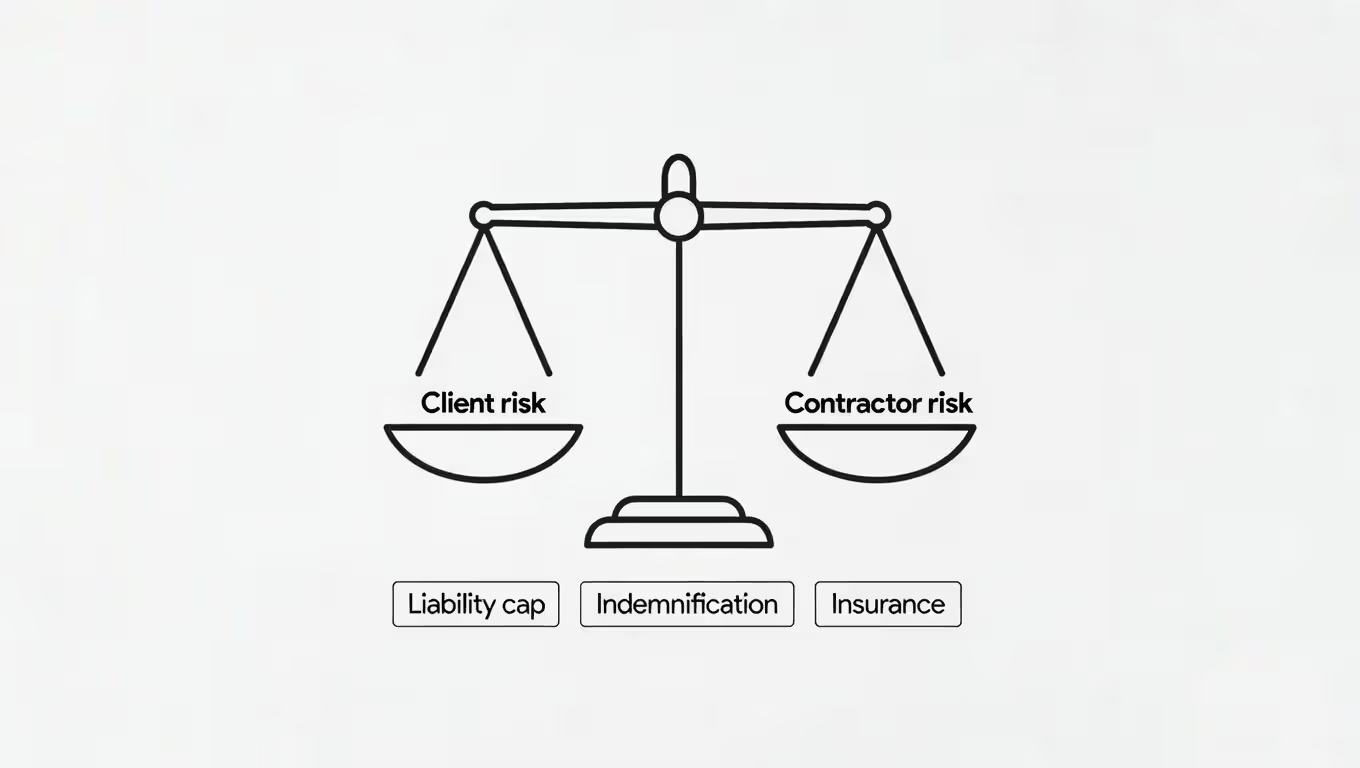

Liability and Indemnification Provisions

Contractor liability terms allocate risk between parties. A limitation of liability clause caps damages at a specific amount—often the contract value or a multiple of it. Without this protection, a contractor paid $5,000 could face a $500,000 lawsuit if deliverables cause business losses.

Indemnification clauses require one party to cover the other's legal costs under certain circumstances. If a contractor uses unlicensed stock photos and the client gets sued for copyright infringement, an indemnification clause makes the contractor responsible. Conversely, if a client's requirements cause the contractor to violate regulations, the client should indemnify the contractor.

Insurance requirements add another protection layer. Businesses often require contractors to maintain professional liability insurance (errors and omissions coverage) and general liability insurance. A contractor working on-site might need workers' compensation coverage, even as a solo operator.

Smart contractors negotiate mutual indemnification and reasonable liability caps. A freelance writer shouldn't accept unlimited liability for a $2,000 blog post project. Likewise, businesses shouldn't agree to indemnify contractors for their own negligence or willful misconduct.

Confidentiality and Non-Disclosure Terms

Confidentiality clauses protect sensitive information contractors access during engagements. Define what qualifies as confidential: customer lists, pricing strategies, unreleased product details, or proprietary processes. Exclude information the contractor already knew, developed independently, or that becomes publicly available through no fault of theirs.

Specify confidentiality duration. Perpetual confidentiality obligations are common for trade secrets but unreasonable for routine business information. Five years post-contract often balances protection with contractor freedom.

Address return of materials. When the relationship ends, contractors should return or destroy confidential documents, files, and data. This matters particularly for customer data subject to privacy regulations like CCPA or HIPAA.

Non-disclosure terms in freelance contract clauses sometimes include non-solicitation provisions preventing contractors from recruiting the client's employees or customers. Courts scrutinize these carefully; overly broad restrictions that prevent contractors from earning a living may be unenforceable.

Good contracts don’t create trust — they protect it.

— Robert C. Pozen

Termination Conditions and Notice Requirements

Termination clauses should address both voluntary ending and termination for cause. For voluntary termination, 30 days' written notice is standard, giving both parties time to transition. Specify whether notice can be shortened by mutual agreement.

Termination for cause allows immediate ending when one party materially breaches the agreement. Define what constitutes material breach: repeated missed deadlines, failure to pay invoices, or disclosure of confidential information. Include a cure period—typically 10-15 days—allowing the breaching party to fix the problem before termination takes effect.

Address payment upon termination. If a client terminates a project halfway through, does the contractor receive 50% payment? Full payment for completed milestones? A "kill fee" covering contractor opportunity costs? Without clear terms, disputes inevitably follow.

Include provisions for work product upon termination. If a client terminates a web development project, do they receive partially completed code? Only if payments are current? These details prevent hostage situations where contractors withhold work or clients refuse payment for incomplete deliverables.

Independent Relationship Acknowledgment

The independent relationship acknowledgment is the agreement's most critical classification safeguard. This clause explicitly states that the contractor is not an employee and has no authority to bind the business to contracts or commitments.

Strong language includes: "Contractor is an independent business entity responsible for all taxes, insurance, and regulatory compliance. Nothing in this agreement creates an employment relationship, partnership, or joint venture. Contractor retains sole control over work methods, schedule, and location."

Reference tax obligations specifically. State that the contractor will receive IRS Form 1099-NEC rather than W-2, and is responsible for self-employment taxes. While this clause alone doesn't guarantee proper classification, it demonstrates both parties understood and intended an independent contractor relationship.

Address benefits explicitly: "Contractor is not entitled to employee benefits including health insurance, retirement plans, paid leave, unemployment insurance, or workers' compensation coverage." This reinforces the distinction from employment.

Common Mistakes That Invalidate Contractor Relationships

Author: David Kessler;

Source: skeletonkeyorganizing.com

Businesses often sabotage their own independent contractor agreements through practices that suggest employment. Requiring contractors to work specific hours at company offices using company equipment makes IRS classification challenges likely. The contractor relationship law focuses on the reality of the working relationship, not just contract language.

Behavioral control red flags include training contractors on company methods rather than letting them apply their expertise, requiring approval for routine decisions, or evaluating work processes rather than just results. If you're micromanaging how a contractor completes tasks, you're treating them like an employee.

Financial control issues arise when businesses reimburse contractor expenses, provide tools and equipment, or prevent contractors from working for competitors. True independent contractors invest in their own businesses, use their own tools, and serve multiple clients simultaneously.

Payment structures that resemble employment create problems. Paying contractors hourly wages every two weeks through payroll systems (rather than invoicing) suggests employment. So does providing steady, ongoing work without defined project endpoints. A "contractor" who's worked full-time for two years on indefinite assignments looks like a misclassified employee.

Missing or vague scope definitions cause different problems. When deliverables aren't clearly specified, disputes become inevitable. A client expecting 20 hours of work per week will clash with a contractor who understood the project as deliverable-based with flexible scheduling.

Failure to address tax responsibilities creates liability. Businesses must collect Form W-9 from contractors and issue Form 1099-NEC for payments exceeding $600 annually. Missing these requirements triggers IRS penalties and raises audit red flags. The IRS assumes unreported payments represent employee wages subject to employment taxes unless proven otherwise.

Some businesses try to avoid worker classification issues by labeling everyone contractors regardless of the actual relationship. This approach fails spectacularly during audits. Classification depends on the working relationship's substance, not labels. An agreement calling someone a contractor while treating them as an employee provides no protection.

State-Specific Considerations and Federal Compliance Requirements

Author: David Kessler;

Source: skeletonkeyorganizing.com

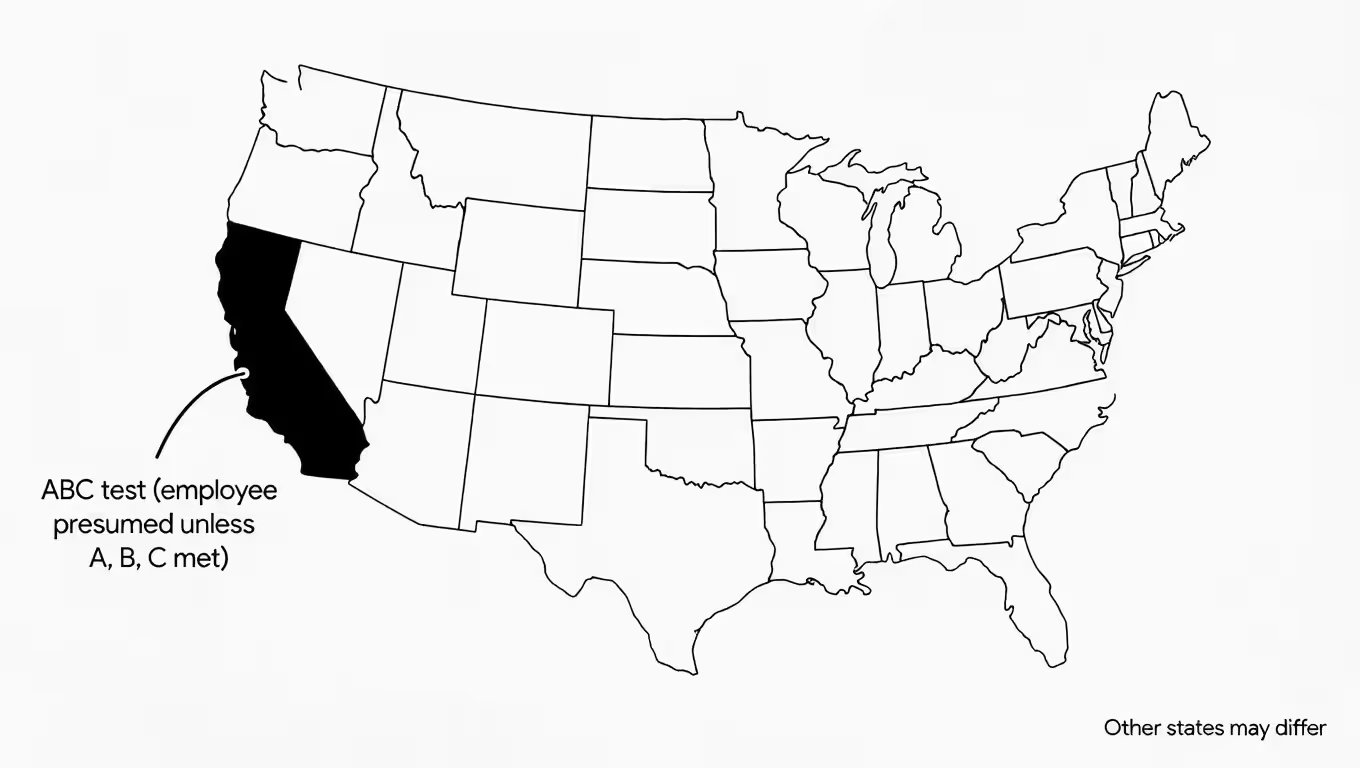

Federal contractor relationship law provides baseline standards, but states often impose stricter requirements. California's ABC test, adopted by several other states, presumes workers are employees unless the business proves: (A) the worker is free from control and direction, (B) the work performed is outside the usual course of the hiring entity's business, and (C) the worker is customarily engaged in an independently established trade or occupation.

The ABC test's "B" prong creates particular challenges. A marketing agency hiring a freelance copywriter might fail this test because writing marketing copy is within the agency's usual business. The same agency hiring a plumber to fix office sinks would likely pass.

Multi-state contractor issues complicate compliance. A New York business hiring a California contractor must consider both states' laws. Some states assert jurisdiction over contractors working remotely for in-state businesses. Others focus on where the contractor is physically located. This patchwork requires careful analysis for businesses with distributed contractor networks.

The Department of Labor's 2024 rule change returned to a multi-factor "economic reality" test for determining employee status under the FLSA. This test examines: opportunity for profit or loss, investment in the work, permanence of the relationship, nature and degree of control, whether work is integral to the business, and skill and initiative. No single factor is determinative; regulators assess the totality of circumstances.

Recent enforcement trends show increased scrutiny of contractor relationships. State labor departments, motivated by lost unemployment insurance and workers' compensation revenue, actively audit businesses. The penalties for misclassification include back pay, unpaid overtime, benefits, tax penalties, and fines—often totaling several times the original compensation.

IRS Form W-9 collection should happen before paying contractors. This form provides the contractor's legal name, business structure, and tax identification number—information necessary for issuing Form 1099-NEC by January 31 following the tax year. Businesses that fail to collect W-9s face backup withholding obligations, requiring them to withhold 24% of payments and remit it to the IRS.

Form 1099-NEC reporting requirements apply to payments of $600 or more to contractors during the tax year. File these forms electronically if issuing 250 or more, or submit paper copies for smaller volumes. Late filing triggers penalties starting at $50 per form, increasing with the delay's length.

Some payments don't require 1099-NEC reporting: payments to corporations (except law firms), payments for merchandise, rent paid to real estate agents, or payments processed through third-party networks like PayPal that issue their own 1099-K forms. Understanding these exceptions prevents unnecessary filings.

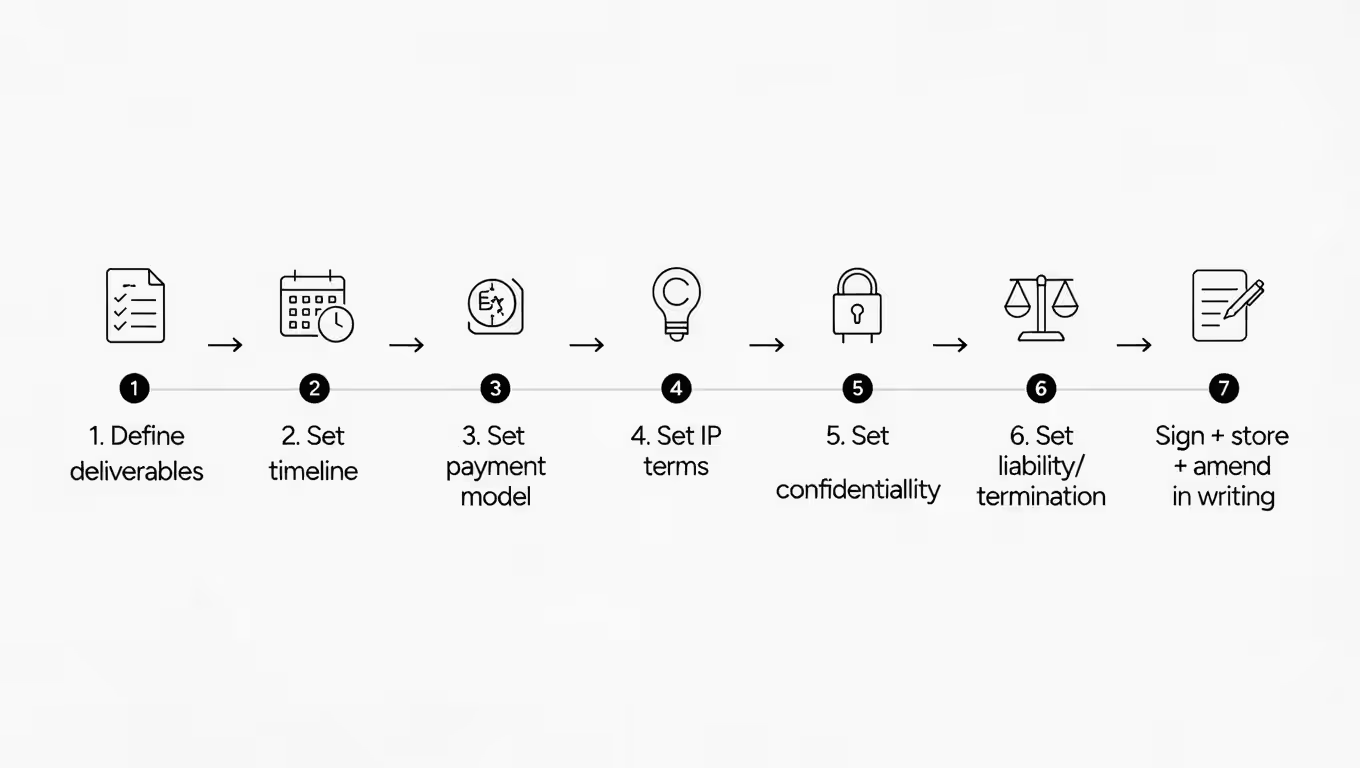

How to Draft or Modify Your Contractor Agreement (Step-by-Step)

Author: David Kessler;

Source: skeletonkeyorganizing.com

Begin by assessing project needs thoroughly. What specific deliverables do you require? What timeline makes sense? What's your budget? Answering these questions before drafting prevents vague agreements that cause later disputes. For complex projects, create a detailed scope document before touching the contract.

Template usage accelerates drafting but requires customization. Generic templates downloaded from legal websites provide structure but rarely fit specific situations perfectly. A software development agreement needs different provisions than a consulting agreement. Customize templates by adding project-specific details, adjusting payment terms, and incorporating relevant state law requirements.

Critical customization areas include scope of work (make it project-specific), payment terms (match your business cycle and cash flow), intellectual property (consider what you need versus what contractors will accept), and liability limits (balance protection with reasonableness). Delete irrelevant provisions rather than leaving inapplicable clauses that create confusion.

Review the agreement from both perspectives. Would you sign this as the contractor? Are obligations balanced? One-sided agreements that heavily favor one party often signal problems. Contractors may refuse to sign or perform half-heartedly. Clients may face enforceability challenges if terms are unconscionable.

The negotiation process should address concerns openly. If a contractor objects to unlimited liability, discuss reasonable caps. If a client needs tighter confidentiality than the contractor proposed, explain why and find middle ground. Successful negotiations leave both parties feeling the agreement is fair.

Documentation matters throughout the relationship. When scope changes occur, create written amendments rather than relying on verbal modifications. Email confirmations of changes work, but formal amendments signed by both parties provide stronger protection. Track milestone completions, approval cycles, and payment dates.

Attorney consultation makes sense for high-value contracts, complex projects, or situations involving significant risk. A lawyer reviewing a $5,000 contractor agreement might be overkill; legal review of a $200,000 software development contract is money well spent. Many attorneys offer fixed-fee contract reviews, making legal advice more accessible than hourly billing suggests.

Red flags that demand legal review include: contracts exceeding $50,000, projects involving regulated industries (healthcare, finance, education), agreements with extensive liability exposure, international contractor relationships, or situations where intellectual property is particularly valuable.

Some businesses maintain master service agreements with frequently used contractors, then execute project-specific statements of work for each engagement. This approach streamlines repeat engagements while maintaining flexibility for varying project requirements.

Frequently Asked Questions About Independent Contractor Agreements

Properly structured independent contractor agreements protect both businesses and contractors by clearly defining expectations, allocating risks, and documenting the independent nature of the relationship. The agreement serves as both a roadmap for successful collaboration and a shield against legal liability.

The key is balancing thoroughness with reasonableness. Agreements should be comprehensive enough to address likely issues but not so one-sided that contractors refuse to sign. Work scope provisions must be specific without being inflexible. Payment terms should protect both parties' cash flow needs. Liability clauses should limit exposure without eliminating accountability.

Classification compliance requires attention to both contract terms and actual working practices. An agreement stating the contractor is independent means nothing if you're controlling their schedule, providing their equipment, and treating them like employees. Ensure your day-to-day relationship matches the independent contractor model your agreement establishes.

State law variations demand attention for businesses working with contractors across multiple jurisdictions. What works in Texas might fail in California. Regular legal review of contractor agreements—particularly when expanding to new states or significantly changing how you engage contractors—prevents costly compliance failures.

The investment in a well-drafted independent contractor agreement pays dividends by preventing disputes, clarifying expectations, and protecting against misclassification liability. Whether you're a business engaging contractors or a contractor negotiating agreements, understanding these essential elements helps you create relationships that benefit everyone involved.

Related Stories

Read more

Read more

The content on Legal Insights is provided for general informational purposes only. It is intended to offer insights, commentary, and analysis on legal topics and developments, and should not be considered legal advice or a substitute for professional consultation with a qualified attorney.

All information, articles, and materials presented on this website are for general informational purposes only. Laws and regulations may vary by jurisdiction and may change over time. The application of legal principles depends on specific facts and circumstances.

Legal Insights is not responsible for any errors or omissions in the content, or for any actions taken based on the information provided on this website. Users are encouraged to seek independent legal advice tailored to their individual situation before making any legal decisions.