Courthouse building with four generic icons labeled Search, Social, Marketplace, and Mobile OS.

Antitrust Law Developments: Major Cases, Regulatory Shifts, and What's Changing in U.S. Competition Policy

The federal government is simultaneously prosecuting monopolization claims against Google, Apple, Amazon, and Meta — the four most valuable technology enterprises in the nation. One court already declared Google's search operation an illegal monopoly, only to prescribe behavioral fixes rather than a corporate breakup. The FTC's attempt to reverse Meta's decade-old Instagram and WhatsApp purchases collapsed at trial in late 2025, triggering an immediate appellate challenge. And a pending Amazon action, heading for a courtroom showdown in 2026, may permanently alter how platform-based commerce operates.

Not since prosecutors took aim at Microsoft a quarter-century ago has American competition policy generated this much courtroom activity. Anyone tracking big tech antitrust updates — attorneys, investors, policy analysts, or citizens curious about why trillion-dollar companies keep appearing in federal dockets — is watching a landscape in rapid transformation. What happens in these proceedings will dictate the outer limits of corporate scale, reshape how deal-making gets policed, and reveal whether government agencies can effectively check platform power once it takes root.

Note: Status descriptions below rely on public filings current through early 2026. Judicial calendars are inherently unstable — cross-reference with agency press releases or PACER records for real-time accuracy.

Where U.S. Antitrust Enforcement Stands Right Now (2025–2026 Snapshot)

The last several years ushered in an enforcement climate without parallel since the trust-busting campaigns of the early twentieth century — at least in ambition, if not always in result. Federal agencies at both the FTC and the DOJ's competition arm pivoted from a decades-long preference for settlements toward a willingness to try cases, float aggressive legal arguments, and absorb courtroom losses while laying groundwork for future actions.

Lina Khan's four-year stint leading the FTC (2021–2024) redefined what the commission was willing to attempt: higher volumes of merger objections, revival of Section 5 authority (enabling "unfair methods of competition" claims independent of the Sherman Act), and monopolization filings against companies previous chairs had left untouched. Jonathan Kanter's DOJ opened two distinct fronts against Google; his successor under the Trump administration, Gail Slater, carried those forward and backed the Apple prosecution filed in March 2024.

A new White House brought rhetorical recalibration — louder concerns about ideological filtering on social platforms — but left the substantive litigation infrastructure standing. DOJ kept litigating against both Google and Apple. Andrew Ferguson, stepping into the FTC chair, sustained the Amazon prosecution and pushed the Meta defeat into the appeals process. Restraining outsize market concentration persists as that rarest of things in contemporary Washington: a position both parties genuinely share.

The jointly published 2023 Merger Guidelines lowered the bar for when market concentration triggers presumptive antitrust concerns — and the current administration left them operative. These standards govern transactions in healthcare, manufacturing, retail, and finance just as firmly as in software or social media. More proposed combinations are being flagged, approval windows have lengthened across the board, and a growing cohort of acquirers are restructuring or canceling planned transactions before inviting a formal enforcement action.

The Big Tech Cases That Are Reshaping Antitrust Doctrine

DOJ v. Google (Search and Ad Tech — Two Separate Cases)

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

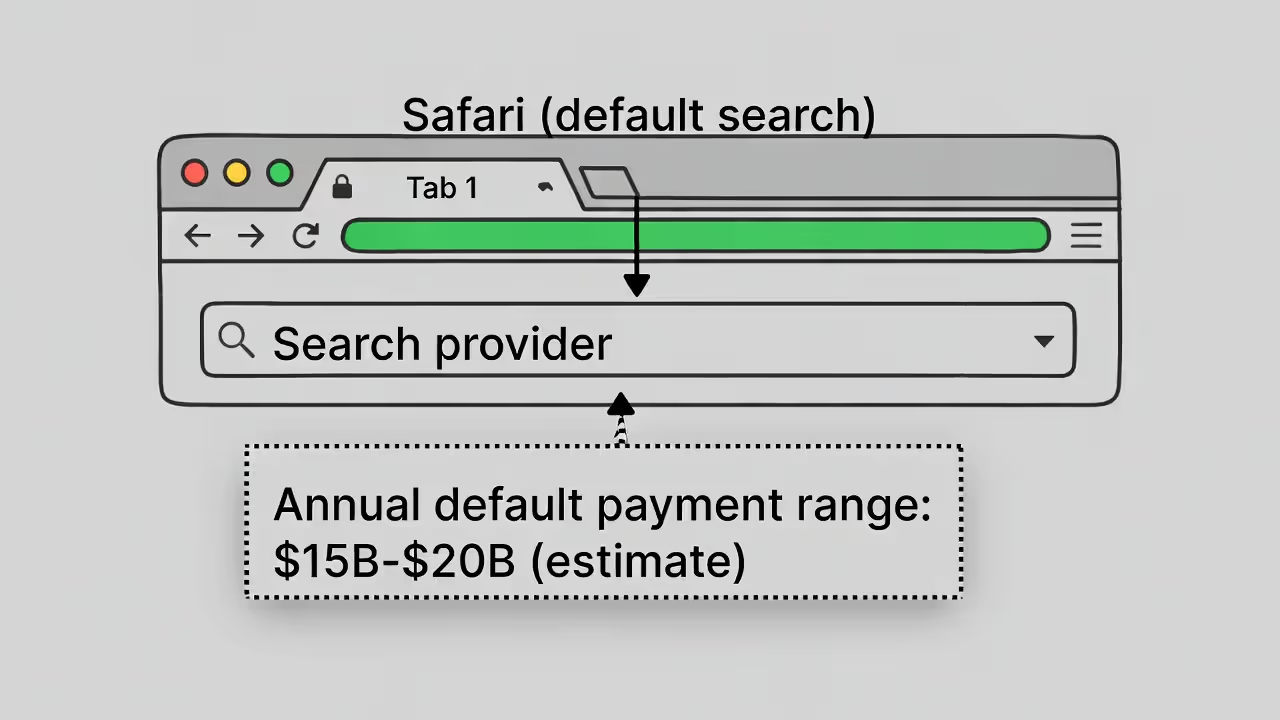

The search-market suit (filed October 2020) delivered what many legal scholars consider the most consequential competition verdict since the Microsoft era. Judge Amit Mehta, in August 2024, held that Google had illegally sustained its stranglehold on general search and search text advertising by locking in exclusive distribution arrangements — the most prominent being an annual payment estimated between $15 billion and $20 billion to Apple for Safari default status.

The September 2025 penalty decision rebuffed the government's push for a structural split — no compelled divestiture of Chrome, no mandated separation of Android — but did install substantive behavioral guardrails: a prohibition on exclusive default-search arrangements and an obligation for Google to grant qualified competitors access to portions of its search index and user-engagement data. Both Google and the DOJ have telegraphed appeals, which could delay a definitive outcome until 2027 or 2028. Generative AI's explosive growth shaped the ruling directly; Mehta cited tools like ChatGPT as nascent competitive forces that reduced the urgency for drastic structural intervention.

The advertising-technology prosecution (filed January 2023, tried September 2024 in Virginia's Eastern District) handed prosecutors a second victory in April 2025, when Judge Leonie Brinkema found that Google had illegally dominated the publisher ad server and ad exchange spaces. The remedies question remains unresolved — prosecutors want a court-ordered sale of Google's AdX exchange, an outcome that would mark the first time a major technology firm has been compelled to shed a core business unit.

FTC v. Meta (Social Media Acquisitions)

Nearly half a decade of legal combat, a six-week trial conducted that spring, and direct courtroom appearances by Mark Zuckerberg — and still the FTC walked away empty-handed. In his November 2025 opinion, Judge James Boasberg concluded the commission failed to establish that Meta wields monopoly power today, crediting TikTok and YouTube as disruptive entrants that have profoundly reshaped competitive conditions since the Instagram purchase in 2012 and the WhatsApp acquisition two years later.

The FTC responded with a January 2026 notice of appeal to the D.C. Circuit, where briefing is now in motion and oral arguments could come in late summer or fall of 2026. A final affirmation of Boasberg's holding would carry sweeping consequences: undoing mergers years or decades after consummation would become practically impossible for federal enforcers — creating something close to a functional expiration date on backward-looking acquisition challenges.

Antitrust law is not about punishing success — it is about preserving competition as the engine of innovation and freedom in our economy.

— Justice Thurgood Marshall

DOJ v. Apple (Smartphone Ecosystem)

Launched in March 2024 in partnership with sixteen state attorneys general, the suit charges Apple with monopolizing U.S. markets for smartphones broadly and premium "performance smartphones" specifically. Prosecutors describe an interlocking series of restrictions: degrading cross-platform messaging quality, withholding smartwatch interoperability from non-Apple devices, suppressing cloud-gaming distribution, and blocking third-party payment pathways within apps.

Apple sought dismissal, but a June 2025 order rejected that motion across all counts, clearing the path toward discovery and, eventually, trial. A final judgment is years away. Yet the legal question being tested carries heavy doctrinal significance: does exercising tight control over a hardware-software ecosystem — as opposed to commanding a traditional product market — qualify as monopolization under Section 2?

FTC v. Amazon (Marketplace Self-Preferencing)

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

Federal prosecutors allege Amazon penalizes independent merchants who price items lower on competing sites — removing their listings from the prominent "Buy Box" feature — and strong-arms sellers into paying for Amazon's own logistics services to secure favorable product placement. Among the more vivid claims: the existence of an internal algorithm, allegedly named "Nessie," engineered to push prices upward when the system forecast that rival retailers would mirror the hike.

An October 2026 trial date is on the calendar at the Western District of Washington. Whatever the outcome, the precedent would ripple across the digital economy — defining the permissible boundaries for any platform operator that simultaneously serves as both host and competitor to the businesses depending on it.

Key FTC Competition Cases Beyond Big Tech

The enforcement wave reaches well past the technology sector. A variety of FTC competition cases in healthcare, food retail, and algorithmic pricing carry direct pocketbook consequences for American households:

| Case / Investigation | Agency | Industry | Primary Legal Theory | Current Status | Potential Impact |

| DOJ v. Google (Search) | DOJ | Technology | Exclusive dealing / monopolization | Conduct restrictions imposed Sept 2025; both sides eyeing appeals | Bars exclusive default-search payments; opens index data to competitors |

| DOJ v. Google (Ad Tech) | DOJ | Technology / Advertising | Monopolization of ad exchange | Government prevailed Apr 2025; remedy determination outstanding | Potential first forced divestiture of a core tech asset (AdX) |

| FTC v. Meta | FTC | Social Media | Anticompetitive acquisitions | Commission lost Nov 2025; appeal initiated Jan 2026 | Shapes viability of unwinding long-closed mergers |

| DOJ v. Apple | DOJ + 16 States | Technology / Mobile | Ecosystem monopolization | Dismissal bid denied Jun 2025; progressing toward discovery | Explores ecosystem dominance as a Section 2 violation |

| FTC v. Amazon | FTC + States | E-Commerce | Self-preferencing / marketplace monopoly | Trial calendared Oct 2026 | Defines acceptable platform conduct toward third-party merchants |

| DOJ v. RealPage | DOJ | Real Estate / Rental | Algorithmic price coordination | Settlement finalized Nov 2025 | Sets benchmark for prosecuting software-enabled price alignment |

| Kroger-Albertsons Merger | FTC | Grocery / Retail | Horizontal combination reducing competition | Courts blocked; parties abandoned the deal | Demonstrates tougher stance on food-retail consolidation |

| PBM Investigations | FTC | Healthcare / Pharma | Unfair methods of competition | Administrative actions continuing | Potential overhaul of pharmacy benefit manager practices |

The RealPage outcome qualifies as an important market regulation development in its own right. Through the settlement terms, the government prohibited the company from circulating competitively sensitive rental-rate data to landlords — establishing the principle that software-intermediated price alignment violates antitrust norms even when no traditional conspiracy exists. Viewed alongside the parallel monopoly investigations across the USA focused on technology firms, these actions confirm that prosecutors are casting a wide net. By mid-2025, 24 state legislatures had collectively filed 51 bills directed at algorithmic pricing practices.

Merger Review Changes: New Guidelines and What They Mean for Deals

Under the 2023 Merger Guidelines, the concentration levels that automatically raise competitive concerns dropped to lower thresholds — opening the door to rigorous examination of a broader universe of proposed transactions regardless of sector. The revised standards also gave new weight to categories of harm that earlier frameworks treated as secondary: impacts on labor markets, elimination of budding competitors, and vertically integrated supply arrangements.

For acquirers navigating the process: the redesigned HSR (Hart-Scott-Rodino) pre-merger filing now requires substantially richer disclosures. Applicants must detail historical acquisition activity, labor-market intersections, and supply-chain structures in ways that earlier forms never demanded. Clearance periods have grown longer. Transactions in the middle market and those backed by private-equity sponsors — categories that once passed through with minimal friction — now regularly encounter extended agency examination.

The Kroger-Albertsons episode crystallizes how the terrain has shifted. With the FTC objecting and federal courts refusing to permit closing, the two supermarket operators abandoned their $25 billion combination — making it the biggest collapsed grocery deal in U.S. history. A decade prior, an equivalent proposal would have almost certainly gone through with a handful of store disposals attached as conditions.

How the U.S. Approach Compares to EU and Global Enforcement

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

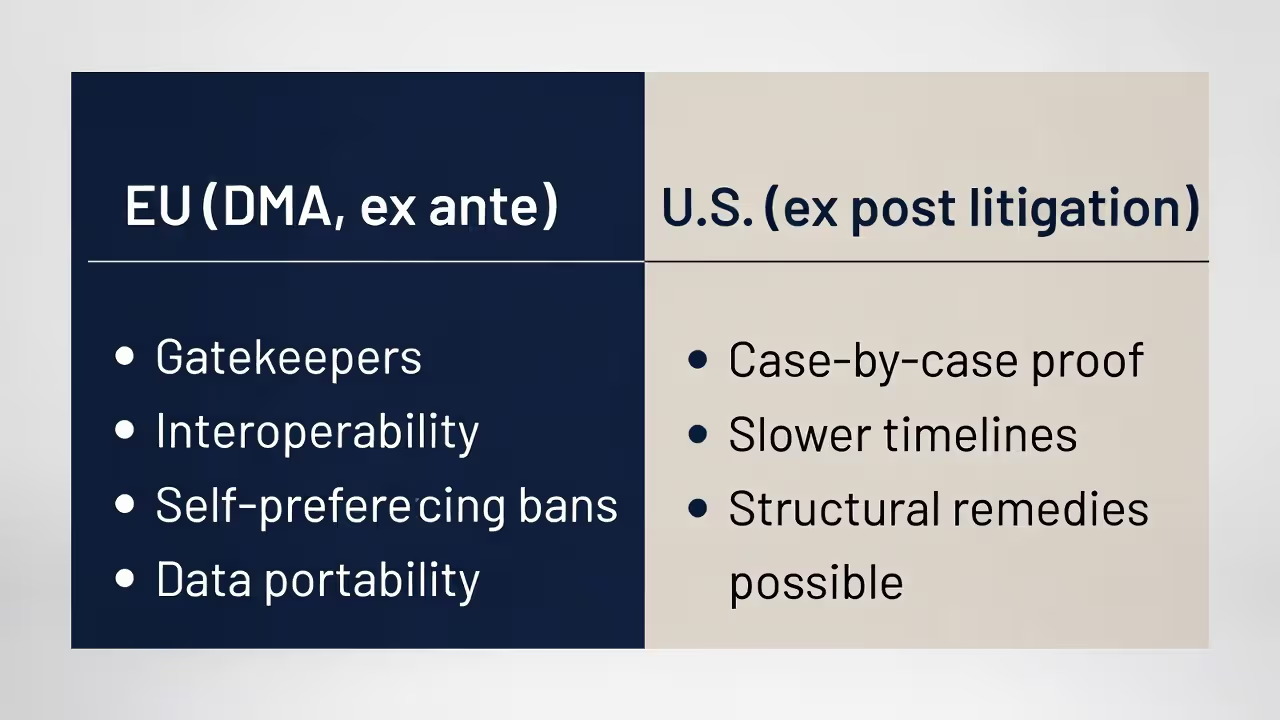

The European Union chose a proactive, rules-based (ex ante) path with its Digital Markets Act (DMA), designating specific firms — Apple, Google, Meta, Amazon, Microsoft, ByteDance — as "gatekeepers" and requiring compliance with behavioral codes before any wrongdoing is adjudicated: mandatory interoperability, bans on favoring proprietary products, and consumer data-portability requirements.

America's framework operates reactively (ex post), placing the burden on prosecutors to prove specific competitive injury through contested litigation once conduct has already taken place. The contrasting models produce distinct tempos: Brussels secures compliance adjustments and imposes monetary sanctions on a faster cycle, while the U.S. adversarial process unfolds slowly but holds open the possibility of structural dissolution — a remedy European regulators have not pursued.

Common ground: the same handful of corporations faces scrutiny on both sides of the Atlantic for overlapping business practices. Divergence: EU proceedings have already yielded tangible behavioral changes (modifications to Apple's App Store policies, compliance portals from Google), while American dockets remain congested with active litigation and enforceable relief sits potentially years ahead.

Other jurisdictions are active as well. Britain's CMA has reshaped or blocked multiple technology acquisitions (extracting concessions in the Microsoft-Activision deal and compelling Meta to unwind its Giphy purchase). Japan's JFTC has opened inquiries into mobile-platform conduct. The pattern is plainly global — yet every country's toolkit and cadence differ.

Author: Michelle Granton;

Source: skeletonkeyorganizing.com

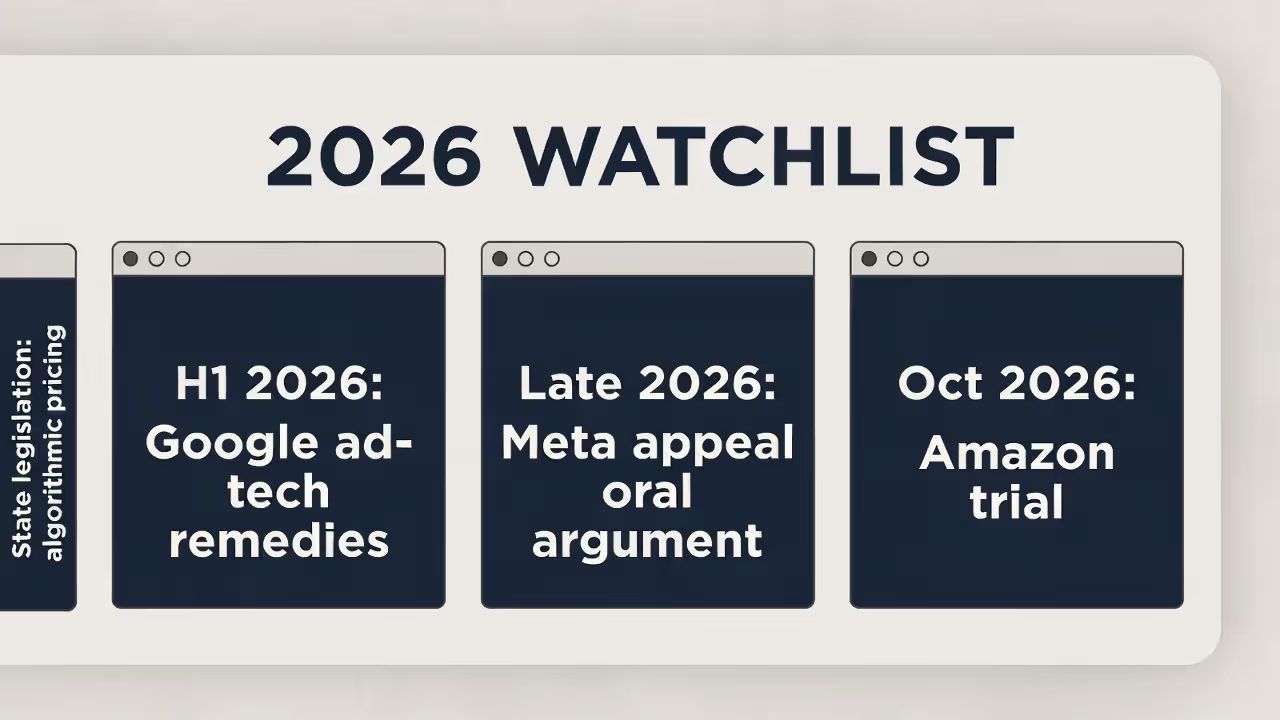

What to Watch Next: Pending Cases, Legislative Proposals, and Enforcement Signals

Google ad-tech penalty. Judge Brinkema's ruling on whether to mandate that Google sell its AdX exchange could land in the first half of 2026. If she orders a forced sale, it would stand as the most muscular competition remedy applied to any technology business since the government broke apart AT&T in 1984.

Amazon marketplace proceedings. On the calendar for October 2026. This will be the first time an American tribunal has put the self-preferencing doctrine through a comprehensive evidentiary test.

Meta's D.C. Circuit appeal. Oral arguments are anticipated in late 2026. The panel's conclusion will settle whether the FTC retains meaningful capacity to unravel acquisitions closed over ten years ago.

Federal legislative proposals. The AICOA and kindred bills have stalled through multiple congressional terms but could resurface. S. 130, the Competition and Antitrust Law Enforcement Reform Act of 2025, would lower evidentiary hurdles for blocking acquisitions by companies that hold more than half of a given market.

State-level activity. California's Law Revision Commission drafted a proposal that would push state antitrust doctrine beyond federal baselines — adoption in 2026 would create a split between state and federal legal standards and likely inspire copycat measures. Texas concluded its own ad-tech suit against Google with a $1.375 billion settlement in May 2025.

Algorithmic pricing statutes. Following the RealPage settlement, anticipate ongoing prosecutions and fresh legislation aimed at software-driven price alignment across rental housing, retail, travel, and food-service industries. This rapidly expanding area of competition law enforcement news is catalyzing more state legislative action than any individual technology-sector prosecution.

FAQ

The breadth of active competition litigation in the United States has no equivalent since the government's confrontation with Microsoft — but the scorecard tells a complicated story. Federal prosecutors notched two liability wins against Google while suffering outright defeat in the Meta case. Penalties imposed so far have been behavioral rather than structural, with no company forced to part with a major asset. Years of appellate proceedings lie ahead. The contests with the greatest potential to reshape legal doctrine — Amazon's marketplace trial, the Google ad-tech remedies ruling, and the Meta appeal at the D.C. Circuit — remain unresolved. For commercial enterprises, the message is straightforward: commanding positions in any market will attract enforcement attention without regard to which party holds the executive branch, standards for evaluating proposed mergers have permanently risen, and using software to synchronize pricing now sits squarely in the government's enforcement crosshairs.

Related Stories

Read more

Read more

The content on skeletonkeyorganizing.com is provided for general informational and inspirational purposes only. It is intended to showcase fashion trends, style ideas, and curated collections, and should not be considered professional fashion, styling, or personal consulting advice.

All information, images, and style recommendations presented on this website are for general inspiration only. Individual style preferences, body types, and fashion needs may vary, and results may differ from person to person.

Skeletonkeyorganizing.com is not responsible for any errors or omissions, or for actions taken based on the information, trends, or styling suggestions presented on this website.