Privacy risk is now a board-level agenda item.

Privacy Litigation Trends Reshaping US Business Compliance

Walk into any general counsel's office today and you'll find privacy litigation sitting at the top of the worry list. Between 2022 and 2024, federal courts logged a 47% jump in privacy-related filings. Settlement checks? They're hitting hundreds of millions of dollars—sometimes more.

Here's what changed: Privacy used to be that thing IT dealt with in the basement. Now it's a boardroom conversation with dedicated budgets, committees, and strategic planning sessions. Why? Because getting it wrong can bankrupt a company.

Several things happened at once. State legislatures started passing laws that let consumers sue directly. Regulators began stretching existing consumer protection statutes to cover new technologies. And plaintiff attorneys—well, they got organized. Really organized. They built playbooks targeting specific tech implementations, created databases tracking which companies use what tools, and started filing coordinated actions across multiple jurisdictions.

Consumers wised up too. After watching massive breach settlements make headlines and receiving class action notices in the mail, people now understand their data has value. Juries reflect this awareness. They're less skeptical of privacy claims than they were five years ago.

If your compliance team understands where enforcement pressure is building, you can actually do something about it. Allocate resources to high-risk areas. Fix problems before they become lawsuits. Build defensible programs that might survive summary judgment.

This analysis digs into where the enforcement action is happening right now, which business practices are generating the most lawsuits, and what companies are doing differently to stay out of court.

What's Driving the Surge in Data Privacy Lawsuits

California's CCPA and CPRA rewrote the rules. For the first time, California residents could collect statutory damages—$100 to $750 per person per incident—without proving they'd been harmed. Think about that. One unauthorized disclosure affecting 100,000 customers creates $10 million in exposure at minimum. No need to show identity theft, financial loss, or even emotional distress.

Thirteen states passed comprehensive privacy laws between 2021 and 2024. Most don't allow private lawsuits, only attorney general enforcement. But here's the problem: Companies now face a patchwork of different requirements across different states. Which law applies to which transaction? What if a Texas customer buys from a Delaware company through a website hosted in Virginia? This complexity itself generates mistakes—and plaintiff attorneys watch for exactly those mistakes.

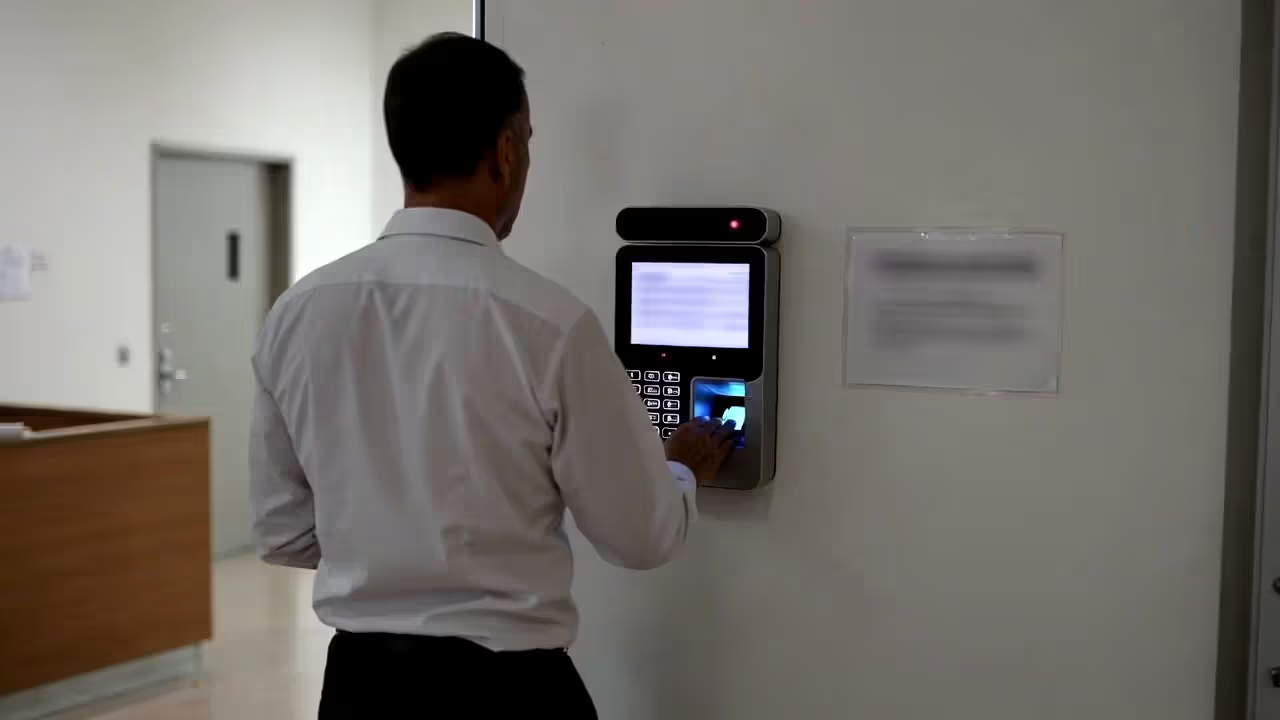

Illinois' BIPA stands alone. It's generated more privacy lawsuits than any other statute, and it's not even close. Why? Private enforcement plus statutory damages ($1,000 for negligent violations, $5,000 for intentional ones). No need to prove harm. Just show the company violated the technical requirements.

Consider a company with 500 employees clocking in via fingerprint scanner twice daily for three years. That's over 1 million scans. At $1,000 each for negligent violations—you're looking at theoretical exposure exceeding $1 billion. Even at aggressive settlement discounts, that's company-ending numbers.

Consumer awareness accelerated everything. People talk about privacy settlements on social media. Class action notices arrive explaining "you may be entitled to compensation." Each publicized case creates a feedback loop—more people check whether they qualify for other actions. Some plaintiff firms now advertise directly to consumers, essentially recruiting class members.

The plaintiff bar industrialized this practice. Specialized firms maintain proprietary databases showing which companies deploy specific tracking pixels, use chatbots with certain features, or collect biometric data. They don't wait for clients to walk in the door—they identify potential violations and then find class representatives. File dozens of similar cases against companies in the same industry. Test different legal theories across different venues to find favorable judges. It's systematic, sophisticated, and very effective.

Author: Andrew Whitaker;

Source: skeletonkeyorganizing.com

Technology Privacy Enforcement: Where Regulators Are Focusing Resources

The FTC shifted gears around 2021. Instead of just addressing data breaches after the fact, they started scrutinizing how companies design products from the ground up. Recent consent orders don't just impose fines—they require companies to implement privacy-by-design principles, obtain independent assessments, and sometimes delete improperly collected data entirely.

State attorneys general coordinated like never before. Multi-state investigations now regularly produce eight-figure settlements. Their focus? Vulnerable populations. Mental health apps sharing sensitive information with ad networks. Educational technology tracking children without proper parental consent. Employment platforms using opaque algorithms to screen job applicants. These cases resonate politically and legally.

Biometric Data Collection Cases

BIPA litigation dominates Illinois federal court dockets. Employers using fingerprint time clocks face class actions. Retailers deploying facial recognition for loss prevention get sued. Websites using voice recognition for customer service become defendants.

Defense arguments vary—we encrypted the data, employees consented through handbook acknowledgments, the biometric identifiers never left the device. Results? Extremely mixed depending on which circuit hears the case.

The Illinois Supreme Court's 2023 ruling in Cothron v. White Castle changed everything. Each biometric scan without proper consent equals a separate violation. Not one violation covering years of scans—a violation every single time. Defense attorneys watched damages calculations multiply exponentially overnight. Companies started settling cases they might have fought before because the exposure exceeded their total insurance coverage and sometimes their entire enterprise value.

Texas and Washington passed biometric privacy laws too, with different requirements. Multi-state employers now face conflicting obligations. Most implement the strictest standard everywhere rather than maintain separate systems for different states. It's simpler and reduces risk, but it's also more expensive.

Author: Andrew Whitaker;

Source: skeletonkeyorganizing.com

AI and Algorithmic Transparency Disputes

AI systems processing personal data for automated decisions are drawing legal fire from multiple directions. The FTC issued warnings about AI tools that discriminate, make unsubstantiated claims, or operate as black boxes. Colorado's AI Act takes effect in 2026 with specific requirements for algorithmic impact assessments and consumer notifications.

Litigation is emerging across several contexts: employment algorithms screening job applicants, insurance pricing models allegedly using protected characteristics as proxies, content recommendation systems accused of amplifying harmful material to children. These cases often combine privacy claims with discrimination allegations, creating complex multi-theory lawsuits that are expensive to defend.

Companies face a genuine tension. Disclose how your algorithm works and you might reveal competitive advantages or trade secrets. Refuse disclosure and regulators demand transparency anyway. Courts are still figuring out how much detail satisfies legal requirements without compromising intellectual property. There's no clear answer yet.

Personal Data Litigation Analysis: Most Common Causes of Action

Privacy lawsuits cluster around predictable patterns. Understanding these patterns helps companies spot their own vulnerabilities.

BIPA violations generate the highest filing volume. Typical scenarios: employers collecting employee fingerprints for timekeeping, retailers using facial recognition, apps accessing biometric data through device sensors. The liquidated damages provision eliminates the causation problem that sinks many consumer cases. No need to prove actual harm when the statute provides fixed amounts.

Unauthorized tracking claims target pixels, cookies, session replay tools, and other technologies capturing user behavior without adequate disclosure. Legal theories vary—state wiretap statutes (especially California's Invasion of Privacy Act), computer fraud laws, common law invasion of privacy. California courts split on whether recording user sessions constitutes illegal wiretapping. Some say yes, others disagree. Defendants face uncertainty.

Data breach negligence lawsuits follow major security incidents, though plaintiffs often struggle proving Article III standing. The Supreme Court made these cases harder to sustain at the pleading stage when information was exposed but not yet misused. Plaintiffs adapted by alleging increased identity theft risk, time spent monitoring accounts, and diminished value of personal information. Some courts buy it, others don't.

Dark pattern claims challenge user interface designs that manipulate consumers into sharing data or making unintended purchases. The FTC prioritized this enforcement area—targeting subscription services that make cancellation difficult, privacy settings buried in complex menus, pre-checked boxes defaulting to maximum data sharing. Cases proceed under FTC Act Section 5 or state consumer protection statutes.

Improper disclosure cases arise when companies share personal information with third parties beyond what privacy policies disclosed or consumers reasonably expected. Healthcare providers sharing patient data with advertising platforms. Financial apps selling transaction histories. Mobile apps transmitting contact lists. All have triggered litigation.

| Violation Type | 2023–24 Case Volume | Average Settlement Range | Top Affected Industries |

| BIPA claims | 850+ | $1M–$50M | Retail, hospitality, healthcare, logistics |

| Unauthorized tracking | 320+ | $500K–$15M | E-commerce, media, financial services |

| Data breach negligence | 280+ | $2M–$100M+ | Healthcare, financial, retail, government contractors |

| Dark patterns | 140+ | $750K–$25M | Subscription services, social media, gaming |

| Improper disclosures | 190+ | $1M–$35M | Healthcare, fintech, mobile apps |

These numbers represent filed cases and publicly disclosed settlements. Many disputes resolve confidentially before filing or through private mediation, so actual figures are higher.

Author: Andrew Whitaker;

Source: skeletonkeyorganizing.com

Privacy Class Action Trends: Settlement Patterns and Financial Impact

Class certification determines whether a privacy lawsuit becomes an existential threat or a manageable problem. Defendants argue individual issues predominate—each consumer had different privacy settings, read different disclosures, suffered different damages. Plaintiffs counter that common questions about the company's uniform practices satisfy Rule 23.

Courts increasingly grant certification when standardized policies or technologies applied to all class members. A website deploying the same tracking pixel on every page faces greater certification risk than a company with individualized customer interactions. This legal reality is actually influencing how businesses structure data practices—some deliberately introduce variation to complicate class treatment.

Settlement values swing wildly based on violation type, class size, and defendant resources. BIPA settlements range from $1.5 million for small employers to $650 million in the Facebook facial recognition case. Data breach settlements typically bundle credit monitoring services with cash payments of $50–$500 per class member. Total values reach nine figures for major incidents.

Plaintiff attorneys collect 25%–33% of settlement funds plus expenses. A $50 million settlement means $12.5–$16.5 million in attorney fees. These economics create powerful incentives to pursue high-value cases. Some firms developed assembly-line approaches—filing dozens of similar cases against companies in the same industry using templated complaints. Change the defendant name, file, repeat.

Defendants complain this encourages opportunistic litigation rather than addressing genuine privacy harms. Plaintiffs argue it's the only way to enforce laws against well-resourced corporations that can outspend individual consumers. Courts remain divided.

Cyber insurance policies often include privacy litigation coverage, but insurers tightened terms dramatically as claim frequency increased. Policies now contain detailed exclusions for BIPA claims, prior knowledge provisions that can void coverage if the company knew about vulnerabilities, and sub-limits for regulatory proceedings. Companies can't assume insurance covers their full exposure. You need to evaluate risk assuming you're self-insured.

Claims-made policy structures create timing traps. A company collects biometric data in 2021, faces litigation in 2024, but only has coverage under the policy in effect when the claim was first made. If you switched insurers or let coverage lapse, you might have zero protection despite paying premiums during the violation period.

Author: Andrew Whitaker;

Source: skeletonkeyorganizing.com

Industry-Specific Vulnerability: Which Sectors Face the Highest Risk

Healthcare organizations juggle overlapping obligations—HIPAA, state health privacy laws, and general consumer protection statutes. The explosion of health apps and wearables blurred lines between regulated entities and consumer technology companies. A hospital clearly falls under HIPAA. But that meditation app collecting information about users' mental health? That fertility tracking app? That symptom checker? The regulatory classification isn't always clear, yet legal exposure is very real.

Mental health platforms attracted intense scrutiny after investigations revealed some shared sensitive information with advertising networks. The FTC settled with BetterHelp and other telehealth companies. Private litigation followed immediately. These cases resonate with juries because mental health information carries significant stigma and genuine harm potential if disclosed.

Financial services firms comply with Gramm-Leach-Bliley Act requirements, state financial privacy laws, and increasingly, general privacy statutes. Fintech companies that don't fit traditional banking definitions sometimes discover they're subject to stricter standards than anticipated. Data aggregators connecting to users' bank accounts, peer-to-peer payment apps, and investment platforms all faced litigation over data sharing practices.

Retail and e-commerce companies deploy extensive tracking to optimize marketing and prevent fraud. These same technologies create litigation exposure. Session replay tools capturing every mouse movement and keystroke triggered wiretapping claims. Sharing customer purchase histories with data brokers for targeted advertising led to improper disclosure cases. Even basic analytics implementations can violate state laws without proper disclosure.

Social media and technology platforms face the highest-profile cases given their massive user bases and data-intensive business models. When you have billions of users, a violation affecting just 0.1% still involves millions of people and potentially billions in statutory damages. These companies also face unique risks from algorithmic content moderation and recommendation systems that might violate emerging AI transparency requirements.

HR and employment technology vendors encounter BIPA exposure from biometric timekeeping, background check systems aggregating personal information, and AI hiring tools analyzing video interviews or parsing resumes. Employers using these tools get sued directly or face vicarious liability for vendor practices. Multi-state employers must navigate different state laws while maintaining consistent HR processes—a genuinely difficult challenge.

| Industry | Litigation Volume Rank | Primary Violation Types | Avg. Settlement Cost | Key Compliance Gap |

| Healthcare | 2 | Improper disclosures, data breaches | $8M–$45M | Third-party vendor management |

| Financial services | 3 | Unauthorized tracking, improper disclosures | $5M–$35M | Consent mechanisms for data sharing |

| Retail/E-commerce | 1 | BIPA, unauthorized tracking, dark patterns | $3M–$25M | Tracking technology documentation |

| Social media/Tech | 4 | BIPA, improper disclosures, AI transparency | $15M–$650M | Algorithmic accountability |

| HR/Employment tech | 5 | BIPA, algorithmic discrimination | $2M–$50M | Biometric consent processes |

Rankings reflect case volume relative to industry size. Smaller industries might have fewer absolute cases but higher per-company risk.

How Companies Are Adapting Their Privacy Programs to Reduce Exposure

Author: Andrew Whitaker;

Source: skeletonkeyorganizing.com

Leading organizations moved beyond checkbox compliance. They embed privacy considerations throughout product development and business operations. Privacy-by-design isn't just a buzzword anymore—it means teams assess data minimization opportunities, build in technical controls, and document decisions before launching new features.

Data mapping became foundational. You can't defend your practices without knowing what personal information you collect, where it's stored, who can access it, and with whom it's shared. Sophisticated organizations maintain dynamic data inventories that update automatically as systems change. Static spreadsheets become outdated the day they're created.

Vendor management programs now include detailed privacy assessments. Third-party pixels, analytics tools, chatbots, and cloud services all process customer data, creating potential liability. Contracts must clearly allocate responsibility, require vendors to maintain adequate security, and provide indemnification for vendor-caused violations. Some companies limit vendor access to de-identified data or use contractual provisions designating vendors as service providers rather than third parties to avoid triggering disclosure obligations.

Consent mechanisms evolved beyond generic privacy policies nobody reads. Layered notices provide brief summaries with links to detailed information. Just-in-time notifications explain data practices at the point of collection. Preference centers allow granular control over different data uses. These approaches improve user experience while creating evidence that consumers made informed choices.

Employee training expanded from annual compliance videos to role-specific education. Developers learn about privacy-enhancing technologies and secure coding practices. Marketing teams understand consent requirements for email and tracking. Customer service representatives know how to handle data subject requests. Distributed responsibility prevents privacy from being solely the legal department's problem.

Documentation practices can determine litigation outcomes. Companies should maintain records of privacy assessments, committee meetings discussing data practices, decisions to implement specific controls, and rationales for balancing business needs against privacy risks. When plaintiff attorneys allege recklessness, contemporaneous documentation showing thoughtful analysis provides powerful defense evidence.

Regular audits identify gaps before they become lawsuits. Internal teams or external consultants test whether actual practices match policies, verify consent mechanisms function correctly, and confirm data retention schedules are followed. Finding and fixing problems proactively costs dramatically less than discovering them through litigation.

Organizations need comprehensive response plans covering both data breaches and other privacy violations. If an employee accidentally sends customer data to the wrong recipient, or a system misconfiguration exposes information, having predetermined assessment, containment, notification, and remediation processes reduces harm and legal exposure.

FAQ: Privacy Litigation Questions from Compliance Teams

Strategic Considerations for Managing Privacy Litigation Risk

Privacy litigation became a permanent fixture in the US business landscape. It's not a temporary enforcement wave that'll pass. Companies treating it as a compliance exercise to minimize often find themselves defending lawsuits that different design choices could have prevented.

The most effective risk management combines legal compliance with user trust. Privacy practices that feel manipulative or opaque create both litigation exposure and reputational harm. Conversely, transparent practices giving users meaningful control can become competitive differentiators while reducing legal risk.

Cross-functional collaboration is essential. Privacy can't be solely a legal issue when engineers write code collecting data, product managers design features requiring personal information, and marketing teams deploy tracking technologies. Organizations embedding privacy considerations into these functions before launch avoid costly retrofits and potential violations.

Resource allocation should reflect actual risk rather than theoretical compliance obligations. A company facing significant BIPA exposure because it collects employee fingerprints should prioritize that issue over comprehensive privacy program elements with lower litigation risk. Practical risk assessment identifies where your specific practices intersect with active enforcement trends.

The privacy litigation landscape will continue evolving as courts interpret existing statutes, legislatures pass new laws, and technologies create novel data practices. Companies that build adaptable privacy programs—with strong governance, regular assessments, and willingness to change practices when risks emerge—will navigate this environment more successfully than those implementing static compliance checklists.

Privacy litigation trends reflect broader societal expectations about how personal information should be treated. Businesses aligning their practices with these expectations, even when not strictly legally required, reduce both litigation risk and the likelihood that future regulations will disrupt their operations. Companies thriving in this environment view privacy as a design principle rather than a legal constraint.

Related Stories

Read more

Read more

The content on Legal Insights is provided for general informational purposes only. It is intended to offer insights, commentary, and analysis on legal topics and developments, and should not be considered legal advice or a substitute for professional consultation with a qualified attorney.

All information, articles, and materials presented on this website are for general informational purposes only. Laws and regulations may vary by jurisdiction and may change over time. The application of legal principles depends on specific facts and circumstances.

Legal Insights is not responsible for any errors or omissions in the content, or for any actions taken based on the information provided on this website. Users are encouraged to seek independent legal advice tailored to their individual situation before making any legal decisions.